Winning Big, Paying Bigger: Sports Betting’s Tax Trap

The sports betting industry is starting to feel the weight of its own success. As its popularity, marketing reach, and revenues climb, so does regulatory pressure. Signs point to tax rates following suit. While actual increases have been limited so far, the conversation around taxation is heating up. James Kilsby, Chief Analyst & VP Americas at Vixio Regulatory Intelligence, helped us gauge the scope of this trend and its potential impact on the market.

Betting Industry Under Growing Regulatory Pressure

The U.S. sports betting industry has had no shortage of action lately. Yesterday’s headlines are often outdated by today, and while the industry’s biggest controversies never fully disappear, they tend to cycle in and out of the spotlight with renewed intensity. Overall, the sector is constantly balancing the interests of operators and regulators, periodically shifting in one direction or the other.

One key issue that remains inseparable from the online gambling industry is taxation. Amid the noise surrounding DFS 2.0, sweepstakes, and prediction markets, tax policy rarely makes front-page news, unless a state lawmaker proposes a tax hike, usually targeting online sports betting. Unlike iGaming, which remains legal in far fewer states, online sports betting taxation is a matter of much broader concern.

For legislators in states facing budget deficits where sports betting is legal but online casinos are not, the go-to solution often seems to be raising taxes on sportsbooks. Given the nature of the business, lawmakers may feel more justified in imposing additional taxes. However, expanding the industry by legalizing online casinos could just as easily help patch budget shortfalls without solely relying on squeezing more revenue from sports betting operators.

The context here is much broader. A full breakdown would mean tackling questions about the industry’s reputation, how public perception has shifted since the fall of PASPA, the messaging around operator products and tools, how states are handling offshore operators (or if they even see the problem), and much more.

But for today, let’s keep things as focused as possible, stepping away only when necessary, to dive into one key topic: taxation.

Tax Rate and Market Dynamics

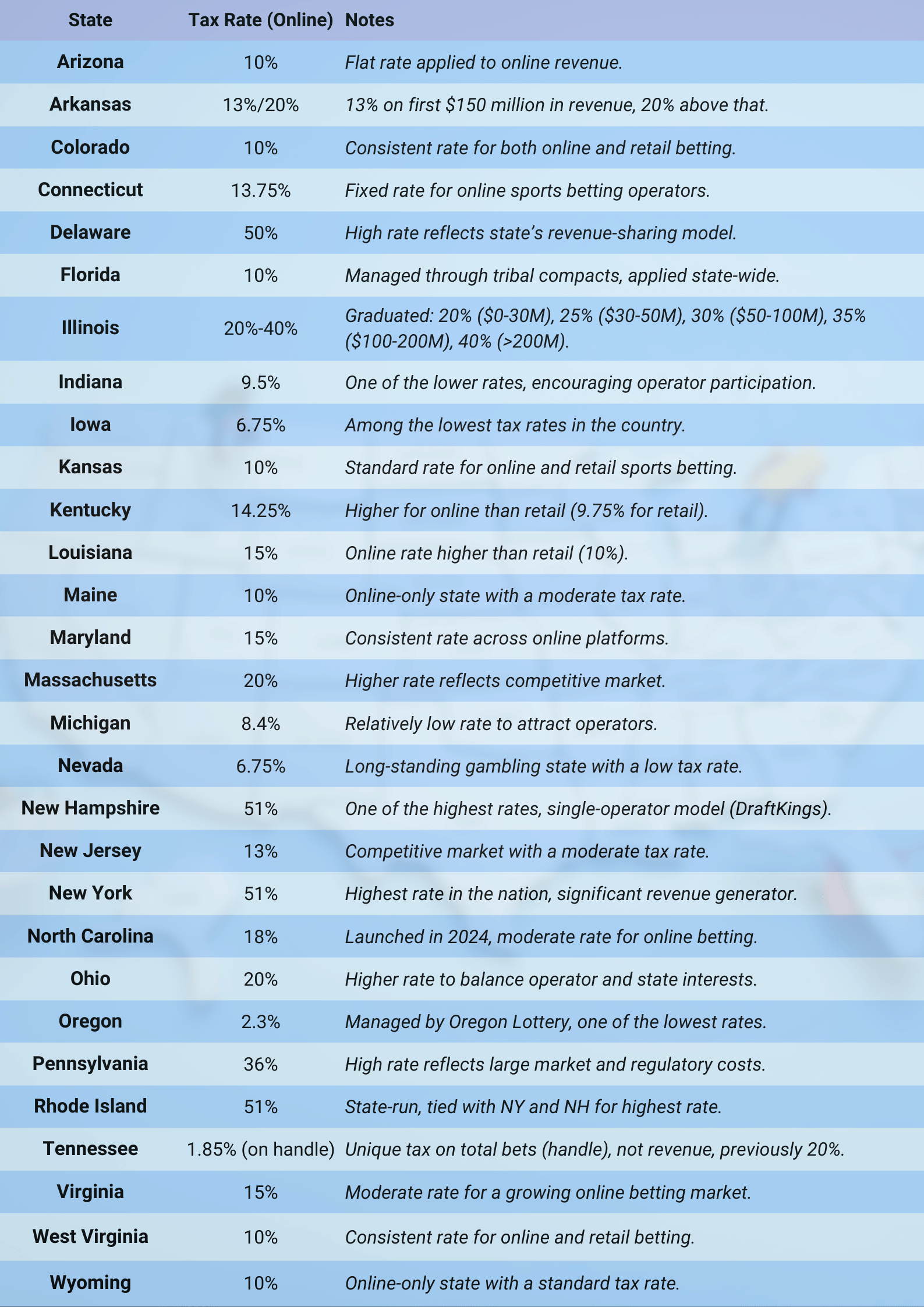

Tax rates for sports betting vary widely by state. Excluding unique cases of state monopolies, they span from 6.75% in Nevada to a national high of 51% in New York. This rate plays a key role in determining a state’s attractiveness to commercial operators.

It’s no wonder, then, that news of potential tax increases prompts swift responses from operators. Since PASPA’s repeal, only two states have raised their rates so far.

Ohio initially set a competitive 10% tax rate, but over time, Governor Mike DeWine observed that states with higher rates generated greater revenue. With a population of about 11.8 million and a growing sports betting market, Ohio had untapped potential. As a result, the rate increased to 20% in July 2023. Encouraged by the outcome, the governor recently proposed raising it further to 40%.

Illinois followed suit last summer. Calling it a “tax hike” may not be exact, as lawmakers introduced a tiered system tied to adjusted gross revenue. Ultimately, even the lowest tier exceeds the previous flat 15% rate for smaller operators. In short, Illinois became the second state after Ohio, and the most recent, to adjust its sports betting tax upward since PASPA ended.

What Does It Mean for Operators?

For operators, this shifting landscape creates real headaches. They entered the market under rules that let them calculate costs and profitability upfront. But in states like Ohio and Illinois, those terms are changing over time. Now, they’re forced to reassess everything and figure out how to handle the added expenses.

James Kilsby, Chief Analyst & VP Americas at Vixio Regulatory Intelligence, spoke to US iGaming Hub about these developments and their impact.

For operators, tax increases in markets where the existing tax rates were generally considered to be reasonable — typically in that 10% to 20% range — present significant challenges. Operators carefully select the markets to enter based on the regulatory and tax environment, and often make long-term strategic investments based on those assumptions. When taxes are raised midstream, it forces operators to reassess their economic model, particularly in terms of marketing spend, customer acquisition, and retention strategies.

In states with higher tax rates, operators will certainly consider whether to scale back promotional spending. This is particularly true for smaller operators, who already struggle to compete with the dominant brands. The net effect is most likely to be a market that increasingly favors the largest operators who have the economies of scale to absorb higher costs, even if doing so reduces their margins.

Leading operators have stated that they have been able to at least partially mitigate the impact of increased taxes in Illinois, but we are also starting to see some — specifically DraftKings — explore more creative ways of doing that whether through the quickly aborted customer surcharge or now in exploring a subscription offering for bettors as a new revenue stream. To the extent that tax increases spread to more states, these mitigation efforts could take on greater importance.

For players, the effects are more subtle but no less real. In higher-tax states, we’ve already seen operators becoming far more judicious with promotional offers, bonus bets, and loyalty programs. Players may also see slightly worse odds or increased margins in certain bet types, particularly in markets where operators are forced to find ways to offset the higher tax burden. Long-term, this creates the risk that players — especially more price-sensitive or higher-volume bettors — migrate to unregulated offshore platforms where pricing is more favorable and promotions more generous.

High tax rates or increases to existing rates have a major impact on the shape of the entire market. They force operators to deal with added costs, which often trickle down to players as well. Players might see a drop in the quality of operator offerings, reduced marketing efforts, or less innovation.

However, as James Kilsby points out, this can also push operators toward greater creativity. Over the past few months, DraftKings has stood out, introducing two innovative approaches to tackle tax rates in heavily taxed states.

Better Get Used to It

Regulatory pressure is mounting, and it seems to be a one-way street. As the industry grows, regulations are likely to tighten further, with tax hikes more common than reductions. All signs suggest that this is the landscape we, as well as operators, need to get used to.

The sports betting industry in the U.S. is dynamic, constantly evolving, and rapidly changing – terms that inevitably come up when discussing it. But this fast pace brings unavoidable risks. The more dynamic and robust the industry becomes, the more lawmakers feel tempted to scrutinize its regulation. Sports betting grabbing headlines isn’t always great news for the industry, paradoxically.

It’s no coincidence that “sports betting” and “budget deficit” increasingly appear together in a single news article or lawmaker statement. The success of a regulated industry draws attention and becomes a weighty argument for opponents or those still on the fence about sports betting.

James Kilsby from Vixio Regulatory Intelligence seems to confirm this:

Vixio has analyzed this issue very carefully and we believe the trend toward tax increases is being driven by a combination of several factors. First, there is the fact that state governments in general are in a worse budgetary situation than they were a few years ago and many are seeking new sources of revenue to counter the end of pandemic relief programs and reduction in other federal outflows. Clearly, increasing the tax rate on sports betting or another form of gambling is more politically palatable than increasing stage income taxes on businesses or on residents.

Second, it is impossible to ignore the influence of New York’s distorting 51% tax rate. The likes of Illinois may look at the $1bn+ in annual tax revenue New York is making and conclude that it hasn’t affected overall handle or suppressed the market, so surely there’s scope for other large markets to raise their own tax rates to closer to that level, too.

Then thirdly, in some respects the industry may be a victim of its own success in that it was generally successful in the first few years of the post-PASPA in advocating for tax rates in the range of 10% on the basis that sports betting was a low margin business, as it historically was in Nevada. The advent of same game parlays and other offerings has boosted the margin of operators so that argument has been somewhat weakened, it’s fair to say.

Over the past couple of months, this dynamic has led to proposed tax increases in New Jersey, Ohio, Louisiana, Indiana, Massachusetts, Maryland, Illinois and Michigan. The proposed, yet-to-be-implemented tax increases would look like this:

- New Jersey: from 13% to 25%

- Ohio: from 20% to 40%

- Massachusetts: from 20% to 51%

- Maryland: from 15% to 30%

- Michigan: from 8.4% to 8.5%

- Louisiana: from 15% to 51%

- Indiana: from 9.5% to 20%.

In addition, Illinois has already introduced a progressive tax, as detailed earlier in the text.

Current Tax Hike Proposals

The latest tax hike proposals have already fizzled out in Louisiana and Michigan, where rates remain unchanged. The odds of success for the rest vary widely. In Massachusetts, relentless Senator John Keenan has again pushed for a steep jump to 51%. That increase alone is a bold shift and a jolt to the market, but paired with SD 1657’s proposals, like banning live betting and adding affordability checks, it becomes a tough pill to swallow. Still, the bill as a whole is a key piece of the state’s sports betting regulation debate.

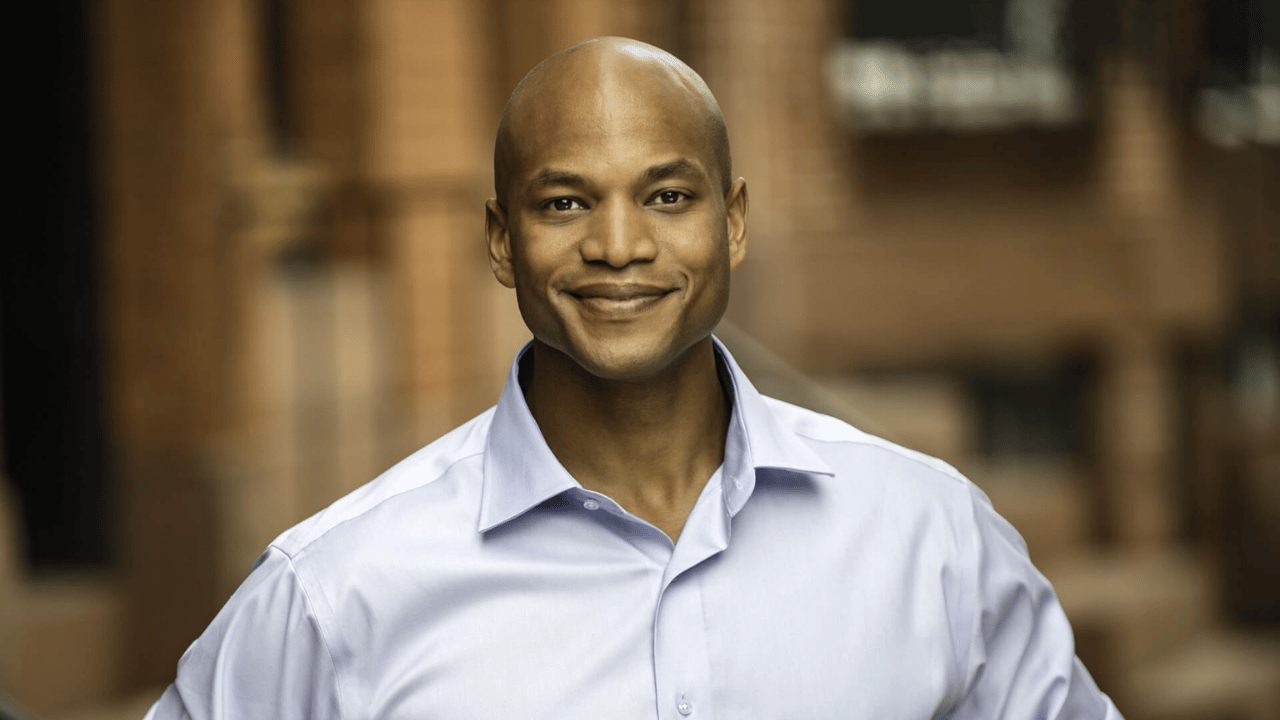

Things get trickier in Maryland. Governor Wes Moore argues doubling the tax rate to 30% could tackle a sizable budget deficit. But another idea surfaced recently: instead of a tax hike, Senator Joanne Benson proposed torching sports betting entirely in the state. Even wilder, both discussions are happening while a bill to legalize iGaming sits on the table.

Governor Wes Moore

Governor Wes Moore

Eilers & Krejcik Gaming (EKG) points to Maryland as the strongest contender to become the third state to raise sports betting taxes post-PASPA.

“Opponents to the tax rise have suggested online casino or iLottery to make up tax revenues; however, we hear these alternatives have not been overly persuasive because they involve much heavier political lifts than simply upping the sports betting tax,” EKG notes in its newsletter.

The proposals in New Jersey and Ohio also look relatively risky for the industry. James Kilsby from VIXIO explains:

Still, it is important to remember that there is a major difference between a Governor proposing an increase as part of a budget package and a tax bill introduced by one state representative or senator, which may make news but realistically is never going to go anywhere. So it’s going to be important for the industry, investors and other observers to separate the serious legislative discussions from those that are far less of a threat.

Of the two states, New Jersey seems slightly more likely at this point. It all comes down to the target tax rate. While Ohio has already pulled off one successful hike, its current 20% rate still feels more reasonable than a jump to 40%. The move to 20% was just a tweak from low to average. Climbing to 40% would be a leap ahead, though nothing’s off the table.

A potential increase in New Jersey, on the other hand, mirrors Ohio’s first hike more closely, making it appear a bit more feasible. At 13%, the state’s tax rate looks pretty modest given its market potential and the national landscape.

What’s the Right Tax Rate?

This brings us to the heart of the issue. What tax rate should be considered optimal, one that lets the market grow while still delivering solid revenue for states? A rate that every state could potentially aim for.

Here, the National Council of Legislators from Gaming States (NCLGS) steps in with its draft Model Internet Gaming Act, offering guidance on the ideal structure for regulating various aspects of online gambling. The NCLGS points to a 15-25% range as relatively sensible, based on how tax rates stack up not just across U.S. states but globally too.

James Kilsby highlights where each state currently falls on this tax continuum:

Still, for all that, we have seen a trend toward higher tax rates, and there is a lot of focus on this area. It’s only Illinois that so far has hiked its rate outside of that 15-25% band as recommended by NCLGS. New York is certainly an outlier, but other later adopting states like Massachusetts and North Carolina are in that zone, while Ohio moved from 10% to 20%, and it remains to be seen if the state’s governor will be successful in passing his proposed budget plan to double that rate again to 40%. New Jersey Governor Phil Murphy is advocating for an increase from 13% to 25%, so again staying in that 15-25% range, albeit stretching just outside once other taxes are included.

Most states are either still far from this unofficial range or have proposed rates that fit within the bracket outlined in the NCLGS draft. However, it’s not about states aiming to land their tax rate precisely in that range, James Kilsby explains:

Longer-term, it is highly unlikely that states will ever arrive at a uniform tax rate for sports betting. States are all over the map in terms of their tax rates for land-based casinos — some have very high rates, and some are much lower. When all is said and done, that’s likely to be the case for sports betting, too.

All signs point to states continuing to differ widely in their tax rates and overall regulatory environments. Still, a clear trend toward higher taxes and stricter rules is emerging. This stems partly from how each state’s market evolves after sports betting launches.

A lower tax rate can jumpstart a new market by creating an operator-friendly setting, letting them invest more and deliver a better product for players. This can be key for drawing customers out of the gray market. Over time, though, the influx of new players slows, and the legal market settles.

At that point, states can start reaping the rewards of their early efforts and expect meaningful tax revenue. This approach seems to lead, sooner or later, to recalculations that result in tax rate hikes. Some modest, some more substantial.

Ultimately, Vixio believes that tax increases will remain a policy risk for the US sports betting market at least for the near-term over the next year or two — already state governors in three large markets in Maryland, Ohio and New Jersey have proposed an increase so far in 2025 and they may not be the last.

Given this, along with budget deficits that need patching, individual tax hikes for specific markets almost feel like a natural next step. James Kilsby even suggests a framework for gauging which states are most likely to lean toward tax increases soon.

When we have analyzed this subject at Vixio, we concluded that the most likely states to consider tax increases were those that have comparatively low rates on sports betting as a starting point especially where they have higher rates for other forms of gaming, they have a budgetary deficit to address or some other clear fiscal need, and either have a history of past gaming tax increases or might otherwise look to the likes of New York or Pennsylvania as peers or comparable states to follow. The likes of Illinois, Maryland and New Jersey would all tick one or more of these boxes.

Pulling all these thoughts together, operators’ protests against tax hikes are their natural right as they defend their interests. Likewise, lawmakers have an equally natural right to raise tax rates to plug budget gaps.

A Victim of Its Own Success?

As the sports betting market thrives, operators face growing responsibility for the broader environment they operate in. The market will expand, lawmakers will look to tax it more heavily, and operators will need to adapt to managing those extra costs.

States, though, need to strike a balance to avoid overdoing it. Smartly tailoring the tax rate to a market’s maturity can yield big benefits, but pushing it too high could hurt the market, slow its growth, or even stall it, ultimately failing to boost state budgets.

For now, the top three contenders for a tax hike are Maryland, New Jersey, and Ohio. Time will tell how these proposals play out in each state.

What we don’t know is whether the proposals put on the table to date will be approved by state legislatures — if so, that will have to be done over the objections of lobbying arguments now being made by the industry. More likely, the governors’ proposals will evolve during the budget process, and we will see what the outcome is in May or June.

Is the sports betting industry a victim of its own success? To some extent, yes, but it seems other consequences of this situation might pose a bigger immediate threat to the market than proposed tax rate hikes.

Recommended