What Is Polymarket? A Beginner’s Guide

Ever wondered how people bet on the future, from election winners to economic shifts? Polymarket, a crypto-driven prediction market, lets users do just that, but Americans are locked out due to strict regulations. Here’s your guide to understanding Polymarket, its mechanics, and legal options you can tap into right now.

Prediction markets are like the internet’s crystal ball, letting people bet on what’s going to happen next. Whether it’s who’ll win an election, if the economy will tank, or even who’ll take home an Oscar. These platforms aren’t just for gamblers; they’re a fascinating way to tap into the collective wisdom of crowds, often outsmarting traditional polls or so-called experts.

Polymarket is one of the biggest names in this space, a crypto-powered platform that’s made waves for its accuracy and innovation. But here’s the catch: if you’re in the US, you can’t use it due to regulatory roadblocks.

Don’t worry, though. This guide breaks down what Polymarket is, how it works, why it’s off-limits for Americans, and what legal alternatives you can explore. Let’s dive in.

Introduction to Prediction Markets

Imagine a place where you can bet on whether it’ll rain this afternoon or if a new policy will pass in Congress. That’s a prediction market in a nutshell. These online platforms let users buy and sell shares tied to the outcomes of real-world events, from politics to sports to economic shifts.

The price of these shares moves based on what people think will happen, acting like a live, crowd-sourced probability meter. If a share for “Will Candidate X win?” costs 60 cents, the market thinks there’s a 60% chance they’ll pull it off.

What makes prediction markets special is their knack for being more accurate than traditional forecasting tools. Why? Because they harness the “wisdom of crowds” – the idea that a group of people, each with their own insights and biases, can collectively predict outcomes better than any single expert.

When money’s on the line, participants are motivated to bet based on real knowledge, not just gut feelings. Polymarket is a standout in this world, but for US folks, it’s a no-go zone due to legal hurdles.

What Is Polymarket?

Polymarket is a decentralized prediction market platform that launched in 2020, based out of Manhattan, New York. It’s built on the Polygon blockchain, a fast and cost-effective layer-2 solution for Ethereum, and uses USDC, a stablecoin pegged to the US dollar.

This setup lets users bet on a huge range of events, think presidential elections, economic trends, sports championships, or even pop culture moments like award shows. Unlike traditional betting sites, Polymarket is peer-to-peer, meaning you’re trading with other users, not the platform itself. It’s all about transparency and cutting out the middleman.

The platform’s decentralized nature, powered by blockchain and smart contracts, ensures bets are secure and payouts are automatic. Polymarket’s markets are known for their accuracy, often beating out polls because they reflect real-time shifts in what people know and believe.

But for all its innovation, Polymarket hit a wall in the US, where strict regulations have made it inaccessible since 2022. We’ll get into that, but first, let’s see how this platform actually works.

How Polymarket Works

Polymarket’s setup is user-friendly yet sophisticated, blending crypto tech with real-world forecasting. Here’s how it goes down:

Trading Shares

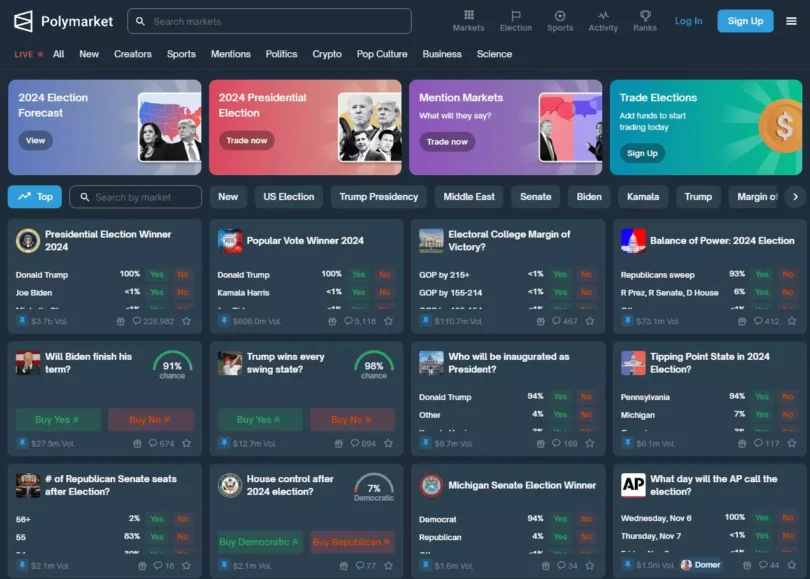

On Polymarket, every market is framed as a yes-or-no question, like “Will the Fed raise interest rates this quarter?” Each question has two types of shares: YES and NO, priced between 0 and 1 USDC.

If YES shares for an event cost 0.25 USDC, the market’s saying there’s a 25% chance it’ll happen. You buy shares based on what you think is likely, using USDC deposited into your Polymarket wallet.

The beauty is, you’re not betting against the house. Polymarket doesn’t take the other side of your trade. Instead, you’re trading with other users, and the platform uses a hybrid system (part centralized order book, part automated market maker) to match trades off-chain while settling them on-chain for transparency.

Each pair of YES and NO shares is fully collateralized, meaning they’re always worth $1.00 together, so payouts are guaranteed. You can also sell your shares anytime before the event resolves to lock in profits or cut losses, making it super flexible.

Real-Time Probability

The prices of shares aren’t set by Polymarket – they’re driven by supply and demand, reflecting what users collectively think. If new info drops, like a breaking news story or a surprise poll, prices shift in real time.

This makes Polymarket a dynamic gauge of public sentiment, often more reliable than traditional forecasts because it’s fueled by people putting their money where their mouth is.

Verification and Payouts

To settle bets, Polymarket uses oracles, independent systems that feed real-world data into the blockchain. Specifically, it relies on UMA (Universal Market Access), an “optimistic oracle” that assumes data is correct unless challenged within a dispute window.

If there’s a disagreement, Polymarket’s Market Integrity Committee (MIC), made up of platform staff, steps in to verify outcomes based on the market’s rules and data sources. Once the outcome is confirmed, smart contracts handle payouts automatically, ensuring everything’s above board.

This mix of blockchain tech, crowd wisdom, and rigorous verification makes Polymarket a powerful tool for forecasting. But for US users, there’s a big roadblock we need to talk about.

Why Polymarket Is Not Available in the US

Polymarket’s US woes stem from a 2022 run-in with the Commodity Futures Trading Commission (CFTC). The CFTC, which oversees derivatives markets, classified Polymarket’s event-based contracts, those yes-or-no bets, as “swaps” under the Commodity Exchange Act (CEA).

In the US, swaps can only be offered on registered platforms, like a Designated Contract Market (DCM) or Swap Execution Facility (SEF). Polymarket wasn’t registered as either, so it was operating illegally.

In January 2022, Polymarket settled with the CFTC, agreeing to:

-

Pay a $1.4 million fine.

-

Shut down noncompliant markets.

-

Block US users from trading, effective immediately.

This wasn’t just a slap on the wrist. It effectively locked Americans out of the platform. The CFTC praised Polymarket’s cooperation, which led to a reduced fine, but the message was clear: prediction markets, especially those in the decentralized finance (DeFi) space, have to play by strict US rules.

Some users have reportedly tried to skirt the ban using VPNs, but Polymarket’s been proactive about enforcing the restriction, and ongoing investigations suggest the feds are watching closely.

Beyond the US, Polymarket’s also been banned in countries like Switzerland, France, Poland, Singapore, and Belgium for violating local gambling laws, showing how tricky the global regulatory landscape can be for prediction markets.

Controversies Surrounding Polymarket

Polymarket hasn’t been without drama. In 2024, it faced serious accusations that stirred up the crypto and prediction market worlds:

Wash Trading Allegations

As the 2024 US presidential election heated up, Polymarket was accused of “wash trading”, a shady practice where someone buys and sells the same asset to fake high trading volume and manipulate prices. Reports from firms like Chaos Labs and Inca Digital suggested that up to a third of Polymarket’s election market volume might have been wash trading.

The spotlight fell on a French trader, dubbed the “Trump whale,” who used four accounts to bet $30 million on Donald Trump’s victory, shifting market odds significantly. When Trump won, the trader pocketed $85 million.

Some cried foul, suspecting market manipulation or even an attempt to sway public perception of the election. Others argued the trader just saw an opportunity where polls were off and bet big.

Polymarket’s internal investigation found no evidence of deliberate manipulation, and their terms of service ban such practices. Still, the episode raised eyebrows about the platform’s vulnerability to big players.

FBI Investigation

In November 2024, things got messier when the FBI raided the Manhattan home of Polymarket’s CEO, Shayne Coplan, seizing his phone and devices. The raid was part of a Department of Justice probe into whether Polymarket was still letting US users trade, violating its CFTC settlement.

Coplan called the raid “political theater” and a “retaliatory” move by the outgoing administration, and crypto industry leaders echoed his frustration. No arrests were made, but the investigation underscores the regulatory tightrope Polymarket walks.

These controversies highlight the challenges of running a decentralized platform in a heavily regulated world, especially when big money and high-stakes events like elections are involved.

Legal Alternatives for US Users

If you’re in the US and itching to try prediction markets, don’t fret, there are legal options that let you get in on the action. Here’s a rundown of the top players:

PredictIt

PredictIt is a New Zealand-based platform run by Victoria University of Wellington, focusing heavily on US politics, like election outcomes or congressional votes. It’s been legal in the US since 2014 under a CFTC “no-action letter,” which lets it operate as a nonprofit for research purposes.

But it’s not all smooth sailing. The CFTC tried to pull that letter in 2022, prompting a lawsuit. As of 2025, PredictIt’s still running, but its future’s a bit shaky.

It uses a continuous double auction system, charges a 10% fee on profits and 5% on withdrawals, and caps investments at $850 per market. It’s not crypto-based, sticking to US dollars, and its election predictions are often cited by media for their accuracy.

Kalshi

Kalshi, launched in 2021 and based in New York, is a fully regulated US exchange under the CFTC’s watch. It offers markets on everything from economic indicators to weather patterns to political outcomes, and it recently won a legal battle to offer election markets again in October 2024.

Contracts are priced from 0 to 1 USD, paying $1 for correct predictions, and Kalshi supports high investment limits, up to $7 million on some markets. It’s not blockchain-based but is accessible to retail and institutional traders alike.

Hedgehog Markets

Hedgehog Markets, a newer player launched in 2021, is a decentralized platform built on the Solana blockchain. It aims to rival Polymarket with fast transactions and low fees, using USDC for trades.

Users can create and trade markets on various events, and it’s developing its own oracle system. Its legal status in the US is murkier, given its decentralized nature, so proceed with caution, it could face regulatory scrutiny down the line.

Comparison Snapshot

Platform

Regulation

Currency

Markets

Blockchain

|

PredictIt |

CFTC no-action (under review) |

USD |

Mostly US politics |

No |

|

Kalshi |

Fully regulated (CFTC) |

USD |

Politics, economy, sports |

No |

|

Hedgehog |

Unclear, decentralized |

USDC |

Varied, expanding |

Yes (Solana) |

Controversial Game Changer

Polymarket is a game-changer in prediction markets, using crypto and blockchain to create a transparent, accurate way to forecast real-world events. Its decentralized setup and reliance on crowd wisdom make it a powerful tool, but US regulations, specifically a 2022 CFTC settlement, have shut American users out, with a $1.4 million fine and a ban on US trading.

Controversies like wash trading allegations and an FBI raid in 2024 show the challenges of operating in a regulated world, but Polymarket’s still a leader globally.

For US folks, platforms like PredictIt and Kalshi offer legal ways to dive into prediction markets, while Hedgehog Markets provides a crypto-based alternative with some risks. As regulations evolve, especially

Recommended