Suspected Google Insider Exploits Betting Loophole for Million-Dollar Payday

A high-stakes scandal has erupted on the prediction platform Polymarket involving a user suspected of trading on stolen corporate data. A trader operating under the alias “AlphaRaccoon” secured more than $1 million in profit by wagering on Google’s internal search rankings before they were public.

The “AlphaRaccoon” Streak

The activity centered on the “Google’s 2025 Year in Search” market. This contract asks users to predict which terms and people will top the search engine’s rankings for the year.

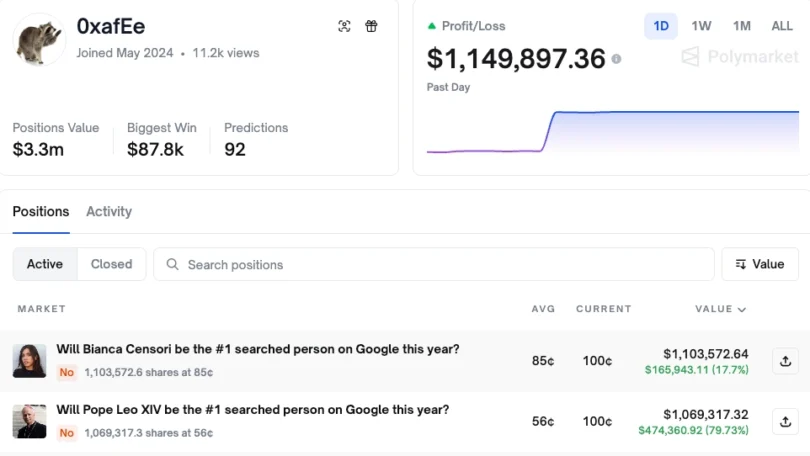

The trader, who later changed their handle to “0xafEe,” placed aggressive bets on highly improbable outcomes. In one instance, the account bet heavily on the singer d4vd to appear as the most searched person.

The market implied a probability of just 0.2% for this outcome at the time. The trader also bet large sums against popular favorites, such as Bianca Censori, eventually profiting over $1.1 million from these positions alone.

The accuracy of the trades was statistically abnormal. The user won 22 out of 23 wagers. These bets did not just pick winners; they correctly identified exact ranking positions, such as who would land in the top five.

Evidence suggests the trader possessed non-public information. Reports indicate Google accidentally published the search data briefly before deleting it.

However, blockchain records show “AlphaRaccoon” placed the wagers well before the accidental leak occurred. This follows a pattern established in November, where the same user earned $150,000 by correctly predicting the exact launch date of Google’s Gemini 3.0 AI model.

Source: The Defiant

Source: The Defiant

The Regulatory Gray Zone

This case highlights a disconnect in United States financial law. In the stock market, a Google employee trading shares based on internal secrets faces criminal prosecution by the Securities and Exchange Commission (SEC).

However, prediction markets operate as derivatives under the oversight of the Commodity Futures Trading Commission (CFTC). Current regulations for these markets do not address insider trading with the same precision as securities laws.

A corporate insider can theoretically wager on non-stock outcomes related to their employer with minimal legal risk.

The existing framework leaves these markets in a “gray zone.” While platforms like Kalshi explicitly ban trading on “material non-public information,” enforcement is difficult.

They argue that betting on outcomes already known to a select few functions more like a rigged game than a fair market.

Platform Constraints and Industry Impact

Polymarket faces a unique challenge in addressing the fallout. The platform operates on the Polygon blockchain using smart contracts.

This decentralized architecture means administrators cannot easily reverse trades or confiscate funds without violating the core principles of the system.

This technical immutability clashes with the platform’s need to secure trust from institutional investors, including recent backers associated with the New York Stock Exchange.

Recommended