Reps. Dina Titus and Guy Reschenthaler Reintroduce Bill to Repeal Federal Sports Betting Tax

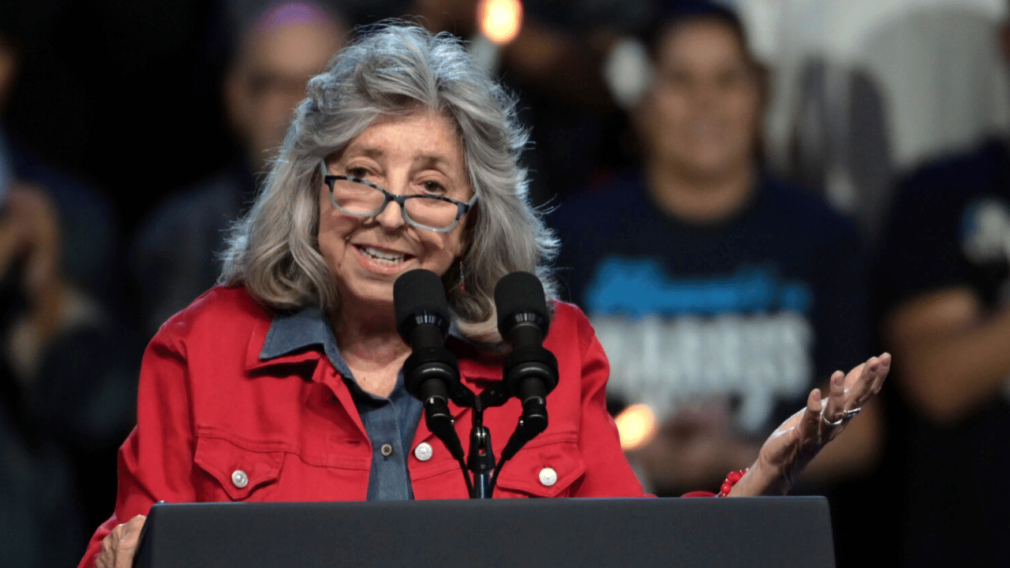

For the fourth time since the legalization of sports betting, a bipartisan effort is underway to eliminate the 0.25% federal excise tax on legal sports wagers. Democratic Representative Dina Titus of Nevada and Republican Representative Guy Reschenthaler of Pennsylvania have reintroduced legislation aiming to repeal the outdated tax, which they argue unfairly penalizes regulated operators while giving illegal sportsbooks an advantage.

What Is the “Handle Tax”?

The excise tax, often referred to as the “handle tax,” was introduced in 1951 as a measure to combat illegal gambling. However, with legal sports betting now operational in 38 states and Washington, D.C., lawmakers say the tax no longer serves its original purpose.

In addition to the 0.25% tax on all wagers, the law also imposes a $50-per-head tax on sportsbook employees. These costs, according to Titus and Reschenthaler, create unnecessary burdens for legal operators while illegal sportsbooks continue to operate tax-free.

Why Lawmakers Want the Tax Gone

Titus, who has long advocated for its repeal, pointed out that even IRS officials could not confirm where the collected tax revenue goes within the federal budget.

“It makes no sense to give the illegal market an edge over legal sportsbooks with a tax the federal government doesn’t even track,” Titus said. She argues that regulated sportsbooks contribute significantly to job creation and economic growth, particularly in Nevada.

Reschenthaler echoed these concerns, emphasizing the broader economic impact of the gaming industry.

“The U.S. gaming industry provides over one million jobs, including 33,000 in Pennsylvania, and generates more than $70 billion in tax revenue for state and local governments,” he noted.

“Unfortunately, outdated tax codes and burdensome regulations penalize legal operators and incentivize illegal activity.”

A Renewed Push After Previous Failures

The Discriminatory Gaming Tax Repeal Act of 2025 marks the fourth attempt by the Congressional Gaming Caucus to eliminate the tax, following similar efforts in 2019, 2021, and 2023.

Each prior attempt failed to gain enough traction in Congress, but supporters remain hopeful that the continued expansion of legal sports betting will sway more lawmakers this time around.

Recommended