PENN Shifts Digital Strategy to theScore Bet, Cites Prediction Markets as Existential Threat

PENN Entertainment confirmed a major shift in its digital strategy during its Q3 2025 earnings conference call. The company announced the early termination of its exclusive sports betting partnership with ESPN Bet, effective December 1, 2025. This move allows PENN to pivot its focus to its unified North American brand, theScore Bet.

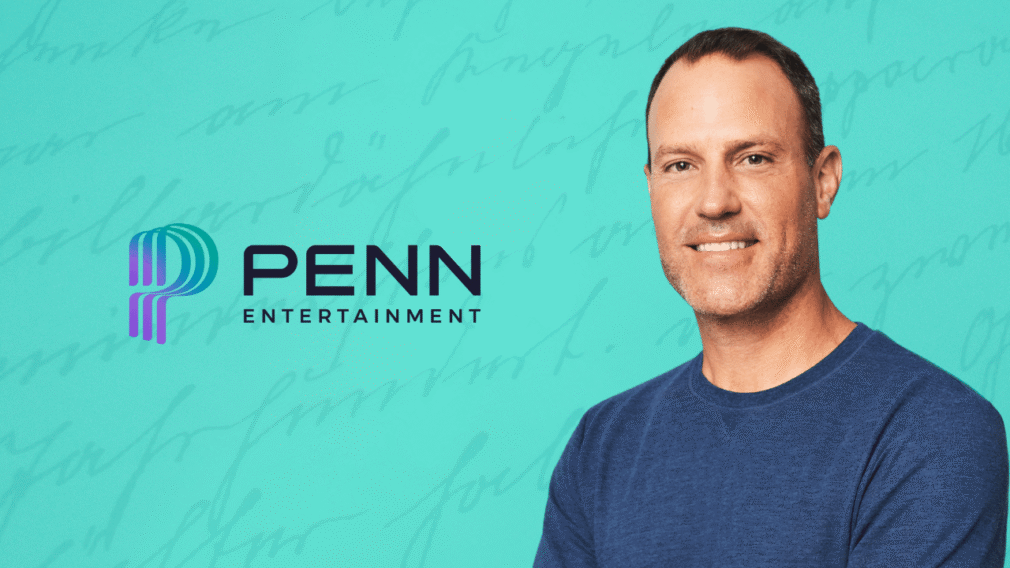

CEO Jay Snowden stated that while the company improved its product and ecosystem with ESPN, they “were unable to establish ESPN Bet as a scale player.” The shift to theScore Bet, which has a track record of strong results in the highly competitive Canadian market, is expected to make the digital operations more efficient. PENN retains ownership of the customer data for the 2.9 million digital users acquired during the ESPN partnership.

Capital Realignment and Interactive Goals

The separation from ESPN frees PENN from annual fixed media payments, allowing for a reallocation of capital. The company plans to strategically invest these resources in high-potential markets, particularly in Canada and U.S. states with legal iCasino operations.

Despite reporting a larger-than-expected loss of $(0.22) per share in Q3, PENN remains committed to its financial target for the digital segment. The company reiterated its goal of achieving break-even or better results in the interactive segment by 2026.

Snowden noted that the iCasino business achieved its highest quarterly revenue to date, growing nearly 40% year-over-year, which will be the central focus of the new digital approach.

New Share Repurchase and Leverage Targets

PENN also announced a new $750 million share repurchase program, set to begin on January 1, 2026. This move demonstrates confidence in the company’s future cash flow generation.

CFO Felicia Hendrix noted that the company plans to continue efforts to reduce its overall leverage. The long-term goal is to bring the debt ratio to somewhat below five times, a move that will be significantly supported once the substantial losses in the interactive segment subside.

Prediction Markets Labeled a “Major Threat”

One of the most critical points of the call was the discussion on prediction markets. CEO Jay Snowden called the rise of these platforms a “major threat to the industry,” suggesting the issue is “existential.”

Snowden emphasized that these markets often operate without key consumer protections, such as responsible gaming safeguards and Know Your Customer (KYC) procedures. He raised a crucial industry concern: if prediction markets can offer contracts on sporting events, what stops them from expanding to contracts on “the next spin of a slot or the next hand of blackjack?”

Snowden urged the regulated industry and lawmakers to “start playing some offense” against this unregulated activity.

Seamless Brand Transition and Retail Stability

PENN’s transition from ESPN Bet to theScore Bet is expected to be seamless for customers. According to Digital Executive Aaron LaBerge, users will not need to download a new application or re-register. The app icon will change, but the user experience will remain identical.

The company’s core retail casino segment showed stable demand throughout Q3, especially in locations without new competitive pressures.

The newly opened Hollywood Casino in Joliet performed strongly. However, markets experiencing increased promotional activity saw a rise in marketing and labor costs, a trend PENN expects to normalize over time.

Recommended