PENN Entertainment Faces a Pivotal Decision: Is This the End of ESPN’s Challenger Brand Dreams?

PENN Entertainment stands at a critical juncture in its operations. Engulfed in a proxy battle and a lawsuit with activist investor HG Vora, the company must decide its future. What fate awaits PENN’s digital assets, and will the battle lead to a sharper focus on its brick-and-mortar business?

How Did It All Start?

The proxy battle between PENN Entertainment and hedge fund HG Vora began in earnest at the turn of 2023 and 2024. HG Vora, then holding an 18.5% stake in the company, launched a campaign in response to a plummeting stock price, which it blamed on a series of strategic missteps by PENN’s management.

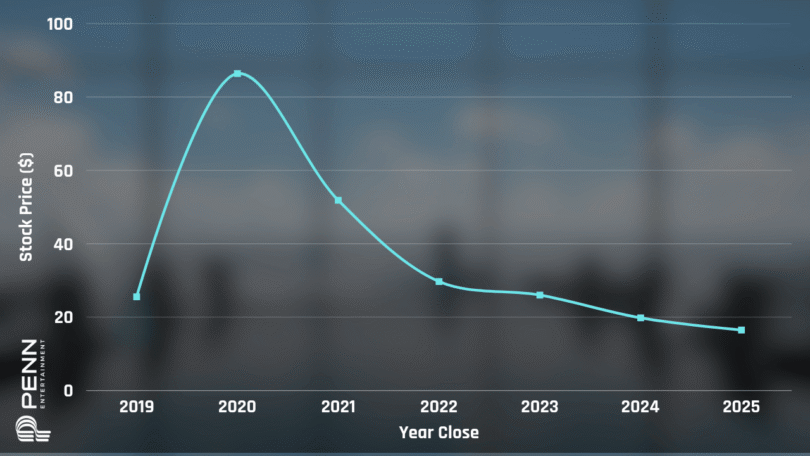

The focus was primarily on poor financial performance and shareholder value erosion. HG Vora argued that PENN’s board and leadership were fully responsible for an 81% stock price drop over four years, claiming the company was “plagued by value-destructive transactions, reckless capital allocation, and poor execution.”

The main point of contention, however, was PENN’s investments in online sports betting. First, the $500 million acquisition of Barstool Sports (later sold for $1), followed by a $2 billion licensing deal for ESPN Bet.

HG Vora contended these “flawed” acquisitions cost the company $4 billion and generated over $1 billion in losses. Objectively, despite its big brand, ESPN Bet fell short of expectations, capturing just 3.2% market share, far below initial goals.

On January 29, 2025, the dispute escalated when HG Vora nominated three independent candidates to PENN’s board: William J. Clifford, Johnny Hartnett, and Carlos Ruisanchez.

The escalation climbed another rung in April when PENN announced it would reduce its board from nine to eight seats, effectively limiting available spots to two. It became clear that seating all three of HG Vora’s candidates would be highly challenging.

HG Vora called this a “self-serving action with no legitimate corporate purpose” and an attempt to block its third candidate, William Clifford. On May 7, HG Vora filed a lawsuit, accusing PENN of violating federal securities laws and breaching fiduciary duties. HG Vora labeled it an “affront to shareholder democracy” and “the most brazen act of entrenchment.”

HG Vora also claimed PENN lobbied state gaming regulators to hinder its licensing efforts, which PENN denied. PENN, in turn, accused HG Vora of flouting regulations, citing a $950,000 SEC fine for prior violations.

Timeline of the Power Struggle

Below, for clarity and to capture all key events, we present a timeline of the final stretch in this battle for influence:

- May 8: PENN CEO Jay Snowden addresses ESPN Bet’s future at an earnings call, mentioning an exit or renegotiation clause after three years (fall 2026) if revenue share thresholds aren’t met. He reports improved Interactive Gaming results but still negative EBITDA.

- May 12: HG Vora files its final proxy statement with the SEC, urging shareholders to vote for its candidates via the “gold proxy card.” It accuses PENN of mismanagement, especially in digital gambling, and criticizes the board seat reduction.

- May 14: PENN issues a letter to shareholders defending its strategy and management, accusing HG Vora of “gross disregard” for gaming regulators.

- May 15: PENN sends another shareholder letter defending its strategy.

- May 19: PENN issues a third shareholder letter.

- May 23: HG Vora sues PENN in Pennsylvania, alleging violations of state law by eliminating a board seat before the 2025 meeting and lobbying regulators.

- May 25: PENN announces it will appoint two HG Vora candidates, Johnny Hartnett and Carlos Ruisanchez, to its board, reducing it from nine to eight. HG Vora rejects this, demanding all three nominees and further management changes.

- May 26: HG Vora continues its campaign, claiming PENN admitted it could expand the board post-meeting, calling it “self-serving” to entrench the current board.

- May 27: PENN CEO Jay Snowden and director David Handler buy PENN shares after a price drop triggered by HG Vora’s report. PENN stresses its digital investments are nearing profitability.

- June 6: Institutional Shareholder Services (ISS) endorses HG Vora’s full slate, including William Clifford, criticizing PENN for a “decade of underperformance” and “misallocation of $4.3 billion to unprofitable interactive ventures.”

- June 7: PENN responds to ISS’s Clifford endorsement, reiterating that Clifford holds “outdated views” and opposed “key initiatives” in the past.

- June 9: AInvest notes PENN’s proxy fight is a “crossroads for governance and growth,” with ISS’s support for HG Vora’s trio a “vote of no confidence” in PENN’s strategy.

- June 10: Glass Lewis, another proxy advisory firm, recommends shareholders vote only for PENN’s two approved candidates, not HG Vora’s full slate.

- June 16: PENN’s stock price is $16.59. Market consensus is “hold,” with a target price of $23.23.

What Now?

The proxy battle between PENN Entertainment and HG Vora is set to be resolved at PENN’s annual shareholder meeting today, June 17. The outcome likely won’t be a shock, as HG Vora is essentially fighting for a non-existent board seat.

HG Vora’s third candidate, William Clifford, won’t secure a board position. PENN reduced its board to eight and rejected Clifford, claiming his skills aren’t “incremental or complementary” and he lacks the “baseline level of openness” required of directors.

Seating two of Vora’s candidates, Johnny Hartnett and Carlos Ruisanchez, is a compromise. PENN didn’t oppose their appointments. A partial agreement is reached, but HG Vora seems to want more.

Even with two of its directors on PENN’s board, HG Vora will gain significant influence. Pressure on PENN’s digital strategy and financial performance will persist. The new board is expected to push for “cost discipline” and greater “managerial accountability.”

The lawsuit filed by HG Vora, accusing PENN of securities law violations and fiduciary duty breaches by shrinking the board, remains ongoing. Though HG Vora didn’t seek a preliminary injunction, the case’s outcome could shape PENN’s future governance.

Post-shareholder vote, the PENN-HG Vora dispute will continue in court. PENN will keep challenging HG Vora’s credibility, highlighting its past regulatory issues. For HG Vora, it’s another way to exert influence and pressure.

What About ESPN Bet?

A key criticism of PENN Entertainment was its misguided digital investments. Could HG Vora’s appointed directors and activist pressure prompt a course correction? It’s not out of the question, especially since CEO Jay Snowden has hinted at a possible shift.

The fate of ESPN Bet remains particularly uncertain. Despite initial optimism, its market share dropped to 3.2% in March, with few signs of near-term improvement. ESPN Bet has failed to carve out a larger market space and lags behind challenger brands like Fanatics and bet365.

Most critically, the ESPN agreement includes an “opt-out” clause after three years (August 2026) if revenue share thresholds aren’t met. PENN’s board may be forced to restructure, sell, or shutter ESPN Bet, especially under HG Vora’s pressure. PENN is doing all it can to bolster the operator, planning further integration with ESPN’s streaming service. So far, such efforts haven’t significantly lifted the brand.

It’s highly likely PENN will consider selling or spinning off unprofitable digital assets to focus on its core casino business and improve liquidity. This could include offloading or selling theScore, which, despite performing well in Canada, a non-core market for PENN, doesn’t sufficiently impact overall operations.

The future of PENN’s other digital brand, Hollywood Casino, which the company heavily bet on recently, must also be considered. The online casino market has far greater revenue potential than sports betting. PENN will need to determine Hollywood Casino’s place in this puzzle.

It’s entirely possible that, regardless of the shareholder vote, PENN will shift more focus to its brick-and-mortar business rather than online sports betting, dominated by FanDuel and DraftKings. PENN faces a defining moment, extending beyond the shareholder vote. Will faith in ESPN Bet prevail, or will the company cut costs and curb digital marketing spend, effectively killing any hope of ESPN Bet surpassing a 5% market share?

Recommended