Pence’s AAF Group Lobbies to Uphold Tax on Gambling Losses

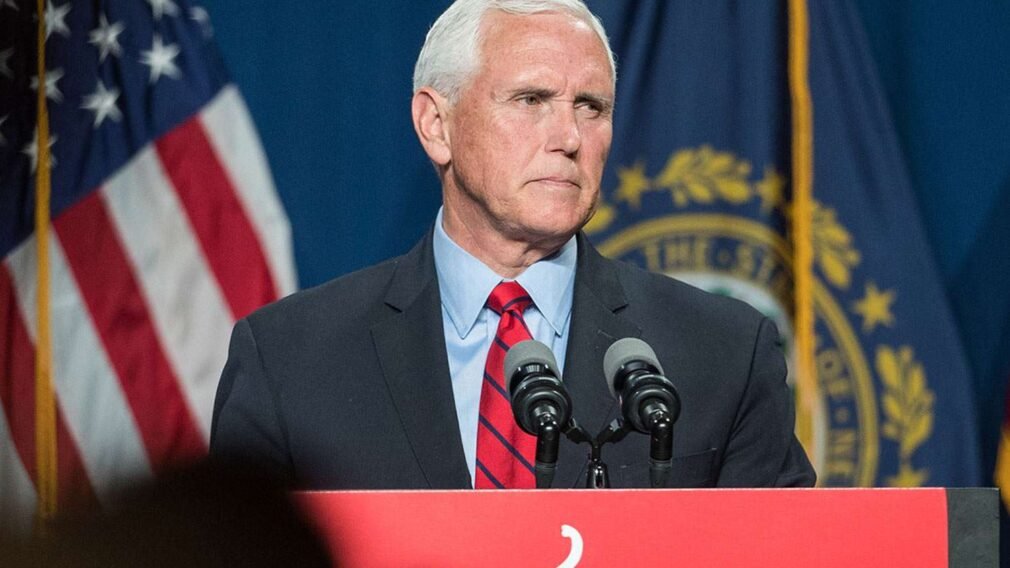

Advancing American Freedom (AAF), a conservative group led by former Vice President Mike Pence, is lobbying Congress to block the restoration of full tax deductions for gambling losses. The move puts the influential think tank in direct opposition to a growing bipartisan effort to repeal the controversial tax change.

A Question of “Pro-Growth” Policy

AAF is framing its opposition as a matter of fiscal responsibility and sound tax policy. The group is targeting a provision in the “One Big Beautiful Bill” that, starting next year, will cap the deduction for gambling losses at 90% of winnings. This means a player who breaks even for the year could still face a significant tax bill on “phantom income.”

In a memo circulated in congressional offices, AAF poses a direct question: “Americans have the freedom to gamble on sports, but why should American taxpayers foot the tax bill for sports gambling?”

The group argues that the tax code should not be used to encourage betting and that lawmakers should instead “encourage a pro-growth tax code by declining to reinstate full expensing for gambling losses.”

A Broader Case Against the Betting Industry

The group’s argument goes beyond tax policy, pointing to the broader social costs of the sports betting boom. AAF’s lobbying materials highlight the industry’s link to a 20-30% rise in bankruptcy rates in states post-legalization. The think tank also contends that sports betting is used to “fund government growth” while harming American families.

AAF draws a clear line between legitimate business expenses and gambling losses, arguing that the former reflects real economic production while the latter does not. This is the foundation of their case that the tax code should not treat the two activities equally.

AAF’s stance puts it in direct conflict with a powerful coalition of lawmakers from both parties who are working to repeal the 90% cap before it takes effect. This bipartisan group, backed by the gaming industry, argues that taxing “phantom income” is fundamentally unfair and will drive players to unregulated offshore markets to avoid the tax.

The lobbying effort by AAF sets up a clear policy showdown in Washington. On one side are pro-gaming advocates focused on industry stability and what they see as fair tax treatment. On the other is a conservative watchdog arguing that the tax code should not be used to subsidize an activity it views as socially and economically harmful.

Recommended