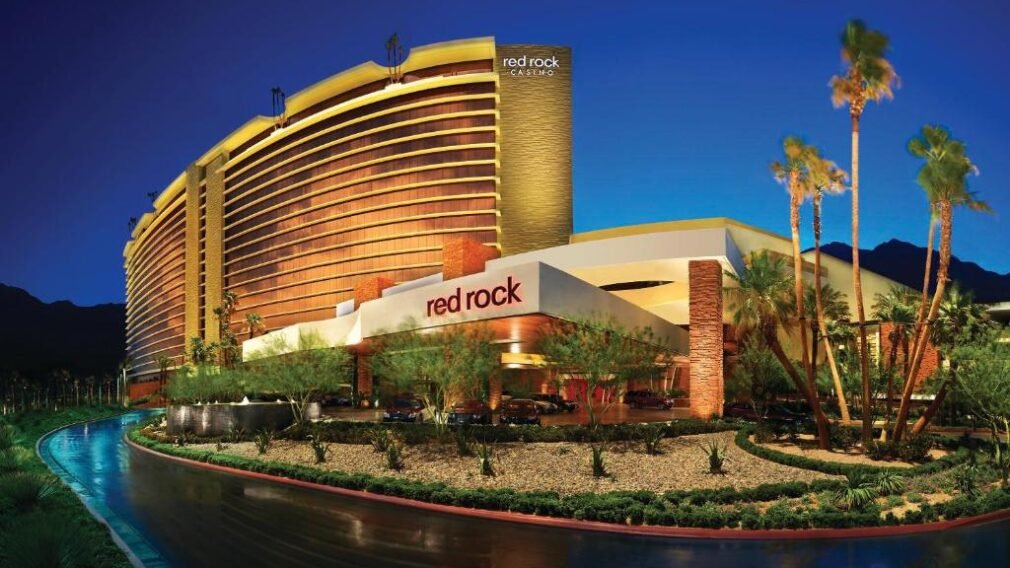

J.P. Morgan Updates Red Rock Resorts’ Outlook

Joseph Greff, an analyst at J.P. Morgan, provided an update on the stock price target for Red Rock Resorts, a subsidiary of Station Casinos.

Initially, the firm raised the target to $69, reflecting optimism driven by the strong performance of Durango Casino and Resort. However, the year-end 2024 target was subsequently adjusted down to $63.

Rationale Behind the Adjustment

Greff cited concerns about the potential impact of a slowdown in the locals consumer segment on Red Rock’s non-higher-end properties.

While the Durango EBITDA contribution remains stable, the adjustment aims to address perceived risks and offer a more conservative forecast. Despite the adjustment, Red Rock maintains an overweight rating, suggesting an 18% potential increase from current levels.

Boyd Gaming Faces Revenue Dip

Boyd Gaming recently disclosed its first-quarter results, noting a slight decline in overall revenue despite a surge in online earnings.

The company reported $960.5 million in revenue, a slight decrease from the previous year’s Q1 figure of $964.0 million. CEO Keith Smith attributed the challenges to heightened competition in the Las Vegas Locals market.

Recommended