iGaming Weekly Recap (March 10–16, 2025): The Tax Factor

The SAFE Bet Act is back on the table and the push for federal sports betting regulation is gaining steam ahead of March Madness. Plus, we’ve got solid proof that DraftKings is gearing up for a potential dive into prediction markets. bet365 went live in Illinois, while New Hampshire and New Jersey wrestle with regulating different areas of gambling. In this week’s bonus section, we return to the topic of taxation, which we covered extensively on US iGaming Hub this week. What else went down last week? Check out our Weekly Recap!

U.S. Congressmen Paul Tonko and Richard Blumenthal have reignited efforts to introduce federal sports betting regulations with the SAFE Bet Act. The bill aims to set uniform nationwide standards, citing a sharp rise in players’ financial losses. Proposed rules include ad restrictions, bans on betting on college athletes’ individual performances and live wagers, plus financial affordability checks and a national self-exclusion list. The gambling industry opposes federal oversight, arguing it infringes on states’ rights and could drive a resurgence of illegal betting.

DraftKings has registered “DraftKings Predict” with the National Futures Association (NFA), signaling a push into the prediction market. Confirmed by company leadership, this move responds to potential regulatory shifts around event contracts, which could allow betting on political outcomes and more.

DraftKings sees this as a chance to diversify beyond sports betting and tap its existing customer base. While the Commodity Futures Trading Commission (CFTC) has historically been wary of such wagers, recent developments hint at a softening stance, piquing DraftKings’ interest. The company aims to stake an early claim in this growing space, despite pushback from some regulators and industry players.

bet365 expanded its U.S. sports betting presence, launching its mobile platform in Illinois on March 13, 2025. This move is part of the company’s aggressive growth strategy across the United States, with recent entries into Indiana, Arizona, North Carolina, Pennsylvania, and Tennessee.

In Illinois, bet365 brings its signature offerings: live betting, same-game parlays, and promotions, though casino games remain unavailable for now, unlike in some states. The firm’s approach hinges on rapid expansion and leveraging its global expertise in the competitive U.S. market, backed by strong revenues and infrastructure investments. Illinois, with its robust sports betting market, is a cornerstone of this plan.

New Hampshire saw an attempt to legalize online casinos, but Senator Tim Lang pulled his bill despite a favorable committee review. The proposed law called for oversight by the state lottery, issuing licenses tied to existing gambling venues, and a steep 45% tax rate.

It also lowered the gambling age to 18, a potentially divisive move. Reasons for the withdrawal aren’t clear. Concerns from operators about the high tax or pushback over the younger age limit might be factors. For now, only online sports betting remains legal in the state.

New Jersey has shifted its stance on sweepstakes casinos. Initially, Assembly Bill 5196 proposed regulating these platforms like existing online casinos. Now, Assembly Bill 5447 pushes for a complete ban, including penalties for illegal operators. The industry group SPGA slams this abrupt pivot, advocating a return to regulation. They argue it would protect players and generate state revenue. The association urges lawmakers to ditch the ban and rethink a regulatory approach.

Bonus: The Tax Factor

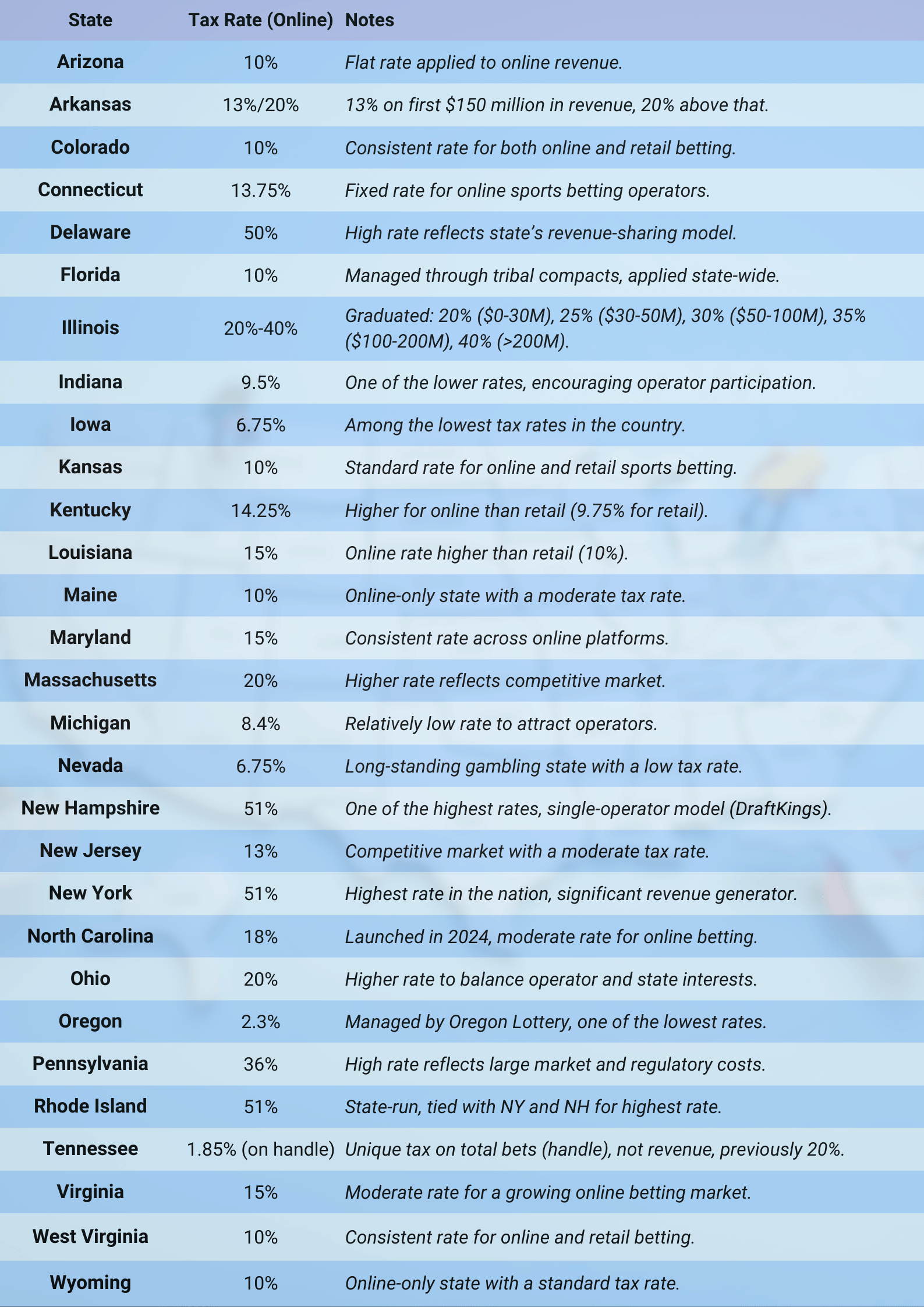

The sports betting industry’s growth, its rising popularity and revenues, comes with a catch: heightened regulatory scrutiny. Taxation is at the core, a topic our recent US iGaming Hub article explores in depth. If you haven’t had time to read it, though we strongly encourage you to, here are a few key takeaways below.

Rates vary sharply, from Nevada’s 6.75% to New York’s 51%, shaping where operators invest. Post-PASPA, Ohio lifted its rate from 10% to 20%, now eyeing 40%, while Illinois adopted a progressive system above its former 15%. Budget deficits and New York’s $1B tax revenue fuel this push.

Operators face pressure, reassessing budgets, scaling back promotions, passing costs to players via slimmer odds and fewer incentives, potentially driving some to unregulated offshore platforms. Larger firms like DraftKings innovate with solutions like Sportsbook+, but smaller operators struggle to compete.

“Leading operators have stated that they have been able to at least partially mitigate the impact of increased taxes in Illinois, but we are also starting to see some — specifically DraftKings — explore more creative ways of doing that whether through the quickly aborted customer surcharge or now in exploring a subscription offering for bettors as a new revenue stream. To the extent that tax increases spread to more states, these mitigation efforts could take on greater importance,” said James Kilsby, Chief Analyst & VP Americas at Vixio Regulatory Intelligence.

A trend toward higher taxes and stricter oversight is evident. States often start with low rates to ignite markets, then raise them as stability sets in. The National Council of Legislators proposes a 15-25% range as balanced, yet uniformity remains elusive.

For now, Maryland, New Jersey, and Ohio stand out as likely candidates for hikes, driven by fiscal needs and peer influence. However, Eilers & Krejcik Gaming (EKG) points to Maryland as the strongest contender to become the third state to raise sports betting taxes post-PASPA.

“Opponents to the tax rise have suggested online casino or iLottery to make up tax revenues; however, we hear these alternatives have not been overly persuasive because they involve much heavier political lifts than simply upping the sports betting tax,” EKG notes in its newsletter.

This pits operators, safeguarding profits, against lawmakers seeking budget relief, a delicate balance. Excessive rates risk stunting market growth.

Is the industry a victim of its own success? Partly, yes. The reasons behind the trend were carefully analyzed by Vixio:

First, there is the fact that state governments in general are in a worse budgetary situation than they were a few years ago and many are seeking new sources of revenue to counter the end of pandemic relief programs and reduction in other federal outflows. Clearly, increasing the tax rate on sports betting or another form of gambling is more politically palatable than increasing stage income taxes on businesses or on residents.

Second, it is impossible to ignore the influence of New York’s distorting 51% tax rate. The likes of Illinois may look at the $1bn+ in annual tax revenue New York is making and conclude that it hasn’t affected overall handle or suppressed the market, so surely there’s scope for other large markets to raise their own tax rates to closer to that level, too.

Then thirdly, in some respects the industry may be a victim of its own success in that it was generally successful in the first few years of the post-PASPA in advocating for tax rates in the range of 10% on the basis that sports betting was a low margin business, as it historically was in Nevada. The advent of same game parlays and other offerings has boosted the margin of operators so that argument has been somewhat weakened, it’s fair to say.

Our full analysis on US iGaming Hub unpacks the drivers, impacts, and debates around optimal taxation. For a thorough look at how this affects operators, players, and state coffers, dive into the article, it’s a valuable perspective.

Recommended