Flutter Entertainment Reports 20% Revenue Growth Driven by FanDuel’s Success in the U.S.

Flutter Entertainment Plc reported a 20% increase in revenue to $3.6 billion for Q2, driven primarily by a nearly 40% surge in FanDuel’s revenue in the U.S. During the Q2 earnings call, the company also responded to the actions of its biggest competitor in the United States, assuring that it has no plans to impose additional fees on players’ winnings.

FanDuel’s Dominance in the US Market

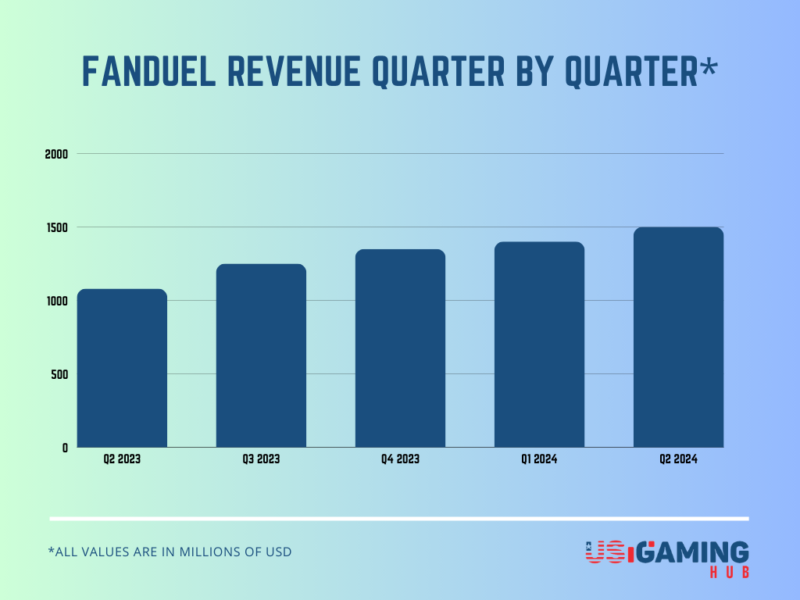

In the United States, Flutter’s FanDuel brand continued to solidify its leadership position, reporting a year-over-year 27% increase in active monthly players to 3.5 million. This growth contributed to a 39% rise in U.S. income, which totaled $1.52 billion for the quarter, compared to $1.1 billion last year.

The operator also reported an impressive 51% increase in adjusted EBITDA, reaching $260 million, up from $172 million in Q2 2023, with adjusted EBITDA margin rise to 17%.

“Our US performance was excellent in new and existing states reflecting our disciplined approach to customer acquisition and our best-in-class product, which offers our sportsbook customers the best pricing in the market. We continue to make improvements to our proprietary product offering which drove the proportion of live betting handle to be more than 400 basis points higher than last year during the NBA playoffs, while we also increased our MLB parlay penetration,” said Flutter’s CEO Peter Jackson.

FanDuel captured a big part of the U.S. online gross gaming revenue (GGR) market, with a 38% overall market share, including a 47% share in sportsbook GGR, 51% in net gaming revenue (NGR), and 25% in iGaming GGR. The migration of FanDuel Casino to proprietary systems further enhanced its iGaming offerings, generating $357 million in Q2 revenues.

Flutter’s U.S. brand also had a strong start in North Carolina, where it achieved a 59% Q2 NGR share. FanDuel is performing well in recently launched markets, with a 45% revenue increase in markets launched in 2022/23, a 33% increase in those launched before 2022, and a 27% revenue growth in markets launched before 2020.

Consequently, Flutter has increased its US revenue guidance by 3% to $6.2 billion, with adjusted EBITDA guidance also raised by 4% to $740 million.

During the earnings call, Peter Jackson also assured that FanDuel does not intend to follow DraftKings’ lead and has no plans to implement a surcharge in states with the highest tax rates. The operator believes that in states like Illinois, the only necessary move is to cut promotional spending.

Strong Performance Internationally

The NYSE-listed company, reported corporate revenues of $3.6 billion for Q2, marking a 20% increase from the $3 billion recorded during the same period in 2023, with adjusted EBITDA of $738 million, 17% more than last year.

The group’s net profits for the quarter surged to $297 million, rising from $64 million in Q2 2023. Despite the impact of non-cash items, including a $147 million charge for amortization of acquired intangibles and a $91 million fair value gain on Fox Option liability, the Group maintained its profitability.

Outside of the US, Flutter’s UK & Ireland division delivered strong results, with Q2 revenues rising to $928 million, an 18% increase from $789 million in 2023. The success of new offerings such as Sky Bet’s QuickBuild feature and Paddy Power’s Super Sub contributed to a 12% increase in sportsbook revenues, which totaled $451 million.

The UK & Ireland unit also benefited from strong cross-sell opportunities, with iGaming revenues increasing by 25% to $423 million. The division delivered the highest adjusted EBITDA contribution to the Group, totaling £293 million with an operating margin of 31.6%.

This growth was largely driven by Flutter’s diverse portfolio of global brands, which served an average of 14.3 million monthly players, a 17% increase from the previous year’s figures.

Recommended