“Esports offers something very difficult to find in traditional sports”

Marek Suchar, Managing Director and Co-founder of Oddin.gg offers an abundance of insights on the esports US and international markets. Is there still untapped potential? Who’s betting on esports and how to address their needs? That’s a must-read for everyone interested in the future (and the present) of betting.

Are we still at a point where many major operators are not fully tapping into the potential of esports? Or have we moved past that stage?

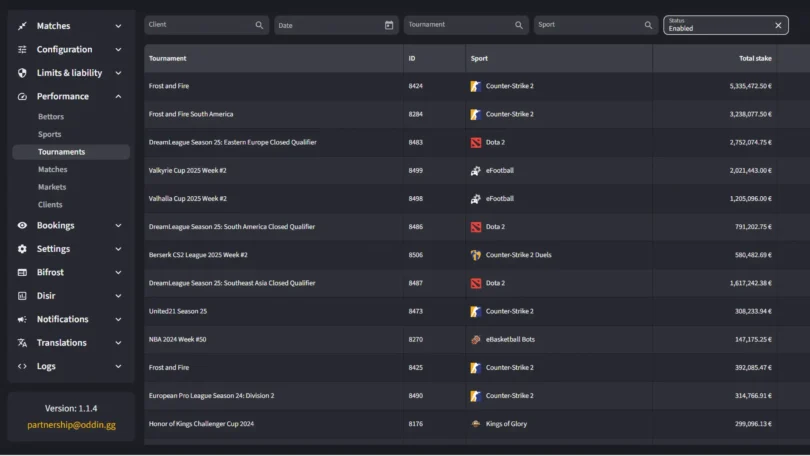

While we’ve certainly seen more attention paid to esports betting over the last few years, I’d say many operators are still just scratching the surface. Esports is no longer a niche space. It’s a massive, global industry with millions of loyal fans and viewers—and that’s clearly reflected in the data. Across our partner network, we saw a 106% year-on-year volume growth from 2023 to 2024 across the four major titles.

Yet in the betting world, it’s often still treated as an “add-on” or side offering. The reality is that esports demands a purpose-built approach. You can’t just copy-paste what works for soccer or basketball and expect it to resonate with esports fans. Operators who try to simply plug esports into their traditional sports model typically see low engagement—and that’s where the gap lies: between what’s possible and how it’s actually being implemented.

That said, things are changing. Forward-thinking operators such as ESPN BET, Betano, Betsson, Betway, and others are already starting to realize that real success requires dedicated infrastructure: esports-specific odds, advanced data capabilities, and interfaces built for speed and live action.

Those who are willing to invest in a customized esports experience are already seeing promising results, and that will only grow as the ecosystem matures.

What potential does esports offer operators compared to traditional sports?

Esports offers something very difficult to find in traditional sports: constant engagement from a digital-native audience. These fans live online. They follow teams, streamers, and communities, and they often play the games themselves.

From an operator’s perspective, that matters—especially when looking to reach Gen Z and younger millennials. These bettors behave differently: they prefer singles over parlays (93% of bets across our network are singles), and they engage live, in the moment. They’re not watching MLB—they’re tuned into Counter-Strike 2 or League of Legends, and they want the same fast-paced experience in their sportsbook.

That shift in behavior is translating into tangible growth. Across the same sub-sample of over 160,000 active esports bettors across our partner network—specifically, those placing bets in both 2023 and 2024—we saw a 70% volume increase year-on-year. That’s not just adoption. That’s real demand and deeper engagement.

Alongside core esports, there’s also growing interest in eSimulators: simulated sports content like eBasketball and eSoccer. These offer a different kind of appeal—familiarity, fast cycles, and 24/7 availability—which resonate well with traditional sports fans and help fill downtime in a sportsbook. For many operators, eSims are becoming a valuable complement to both traditional and esports offerings.

Do you believe that, in an era where players seek instant gratification, the appeal of esports and even simulated sports will continue to grow?

Without a doubt. And we’re seeing that shift already. Today’s consumers—especially Gen Z and younger millennials—expect immediacy. They’re used to engaging in real time, whether through gaming, social media, or content streaming. They don’t wait around.

Esports fits that behavior naturally. The pace is fast, the content is interactive, and there’s a constant stream of in-play moments to bet on: first objectives, next round, head-to-head. That’s why our odds are designed with high uptime and deep market coverage—because that’s what the audience demands.

The eSimulators we mentioned previously—or “eSims” as we call them—offer a similar appeal. These are 24/7, head-to-head matches, not RNG-based virtual simulations. For sportsbooks, they’re an always-on content layer that fills downtime and performs well in short-form betting formats. In fact, across several partners, eSims already make up 8–15% of traditional sports handle in that particular sport—e.g. eBasketball typically generates around 10% of the handle of traditional basketball—and we expect that to continue growing. For operators, adding eSims on top of your sportsbook helps fill content gaps and typically boosts overall handle by around 10%.

Can you identify the three main differences between esports bettors and traditional sports bettors from an operator’s perspective?

It all depends on the type of esports content, but from an operator’s perspective, there are three key areas where esports bettors stand apart.

First, demographics. Core esports bettors—those following titles like Counter-Strike 2 or League of Legends—are generally younger, often between 18 and 30 years old. They’ve grown up with streaming, mobile-first interfaces, and fast-paced digital experiences, and they expect betting platforms to deliver the same. Anything clunky or slow just doesn’t meet their standards.

Second, betting behavior. Esports bettors lean heavily into live markets and single bets. In fact, 93% of esports bets on our platform are singles, and most are placed during matches. The average stake is also significantly higher—around $34 compared to $6 for soccer—indicating a deeper personal investment in each bet.

Third, their motivations and expectations are different. Traditional sports bettors often follow long-standing loyalties or habits. Esports bettors—especially in the eSims segment—are looking for accessibility, speed, and always-on content. While core esports fans value community and content, eSims bettors are more transactional: they want quick bets, clear markets, and a format that fits into their day. The fact that eSims feature live PvP matchups makes them especially attractive for short-form, high-frequency betting.

For operators, understanding these differences is crucial. Esports bettors aren’t just a younger version of traditional ones—they’re a distinct audience with their own rhythms and preferences. Tailoring the experience to those expectations is where the real opportunity lies.

What is Oddin.gg’s vision for capitalizing on the esports space?

Our vision is to offer operators the tools they need to succeed long-term—not just plug a feed into their sportsbook and hope for the best. We’ve built a modular but integrated end-to-end esports ecosystem: odds feed, risk management, BetBuilder, iFrame, widgets, and always-on content like eSims and Duels.

What makes it work is the way we’ve aligned it with how esports fans behave. Our odds engine is built for live betting, our iFrame is optimized for interactivity, and our BetBuilder includes esports and eSims for pre-match and live—something we were the first to market with.

Everything we do is grounded in real data and experience. Our trading team is made up entirely of gamers, we’ve supported some of the biggest sportsbooks around the world, and we continue to maintain excellent client retention across our partner base.

We don’t just want to be part of the esports conversation—we want to help operators by leading it; from the perspective of product, bettor onboarding, as well as educating the market and being the thought partner for regulators.

How do you view the prospects for growth in the U.S., considering what’s already been achieved, current trends, and the characteristics of the American player?

The U.S. market is unique. It’s highly regulated and still developing in terms of esports betting—but the opportunity is enormous. The audience is already there. Streaming platforms like Twitch and games such as Counter-Strike 2, Call of Duty, Valorant are massive in the U.S., and the familiarity with gaming runs deep.

Talking about betting, the formats that resonate in the U.S.—fast-paced, in-play, microbetting with sophisticated Same Game Parlays (SGPs) or Parlay Builders—are exactly where esports excels. And that’s where we’re focused. We’ve already secured licenses in New Jersey, Colorado, West Virginia, Ohio, Arizona, and Ontario, Canada, and we’re continuing to build relationships with regulators and U.S. operators ahead of the curve.

We’ve also already seen a lot of success with eSoccer and eBasketball, but in the U.S., football is king. Based on multiple conversations with operators and market feedback, we’ve been developing an eSims version of American football and expect to go live with our first U.S. client later this year.

As regulation matures and more sportsbooks start viewing esports as a true growth driver—not just a side product—we expect momentum to build. And we’re ready for it, both in terms of tech and operational experience. This is a long game, and we’ve been preparing for it from day one.

Recommended