DraftKings to Implement Tax Gaming Surcharge on Winnings in Four High Tax U.S. States

The financial report for Q2 2024 published by DraftKings on Thursday caused quite a stir in the industry. However, this reaction is not due to the operator’s financial results, but rather the announcement of their intention to implement a gaming tax surcharge in four U.S. states.

DraftKings Announces New Fee on Player Winnings

DraftKings has decided to take an unprecedented step. During the presentation of its Q2 2024 financial results, the operator announced that starting January 1, 2025, it will charge an additional fee on players’ winnings in four U.S. states. The company will implement these measures in New York, Pennsylvania, Illinois, and Vermont—states with the highest taxes imposed on operators.

In New York, companies offering sports betting are required to pay a record-high tax of 51% on net wins. In Pennsylvania, the flat tax rate is 36%, while in Vermont, where tax rates vary by operator, DraftKings pays a 31% tax on net wins.

Did one of the two most powerful sports betting operators in the U.S. make this decision due to recent events in Illinois? Recall that just over a month ago, the state legislature decided to change the tax model, moving away from a flat fee to a progressive tax.

The amount of tax levied in Illinois varies based on the company’s revenue and can reach up to 40% for the highest-earning operators. The minimum rate is 20%, which is imposed on the smallest sportsbooks operating in the state. Nonetheless, even second-tier operators have been subject to higher taxes since July of this year, compared to the previous flat rate of 15%.

We recently examined the consequences of Illinois legislators’ decision pondering who would actually suffer from the implementation of the new tax model. We suggested that, in the end, the tax increase might affect the players themselves. DraftKings’ decision may indicate that these predictions were not far from the truth.

Details of the Gaming Tax Surcharge

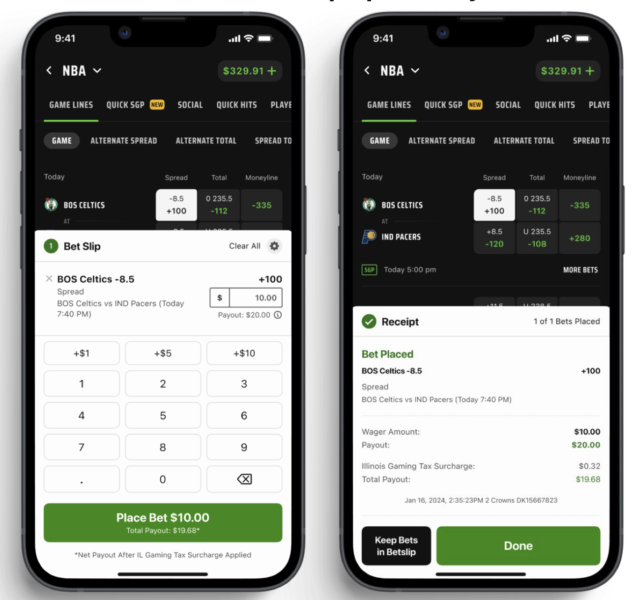

The gaming tax surcharge will apply only to winning bets, where the player’s profit will be reduced by an as-yet undetermined amount.

In its presentation, DraftKings illustrated this with an example: placing a $10 bet at +100 odds, the player’s winnings, which would normally be $20, would be subject to a $0.32 surcharge, resulting in a net win of $19.68.

Although the amount deducted in this example is relatively small, reducing the player’s profit by 3.2%, it can significantly impact a player’s bankroll over the long term. For those who regularly place bets on DraftKings, a 3.2% reduction in profit could entirely change the dynamics and potentially turn a marginally positive return into a long-term loss.

Long-Term Impact

The change implemented by DraftKings could significantly alter the market, which is already struggling with the issue of the black market. The topic of the gaming tax surcharge may be further discussed during the earnings call scheduled for Friday at 8:30 AM EDT.

However, it seems that the more crucial date for the future of the U.S. online sports betting market is August 13, when FanDuel will present its financial report. If DraftKings’ main rival, and the largest operator in the U.S. market, decides to take a similar step, the majority of players in the affected states may be forced to pay the gaming tax surcharge.

What will BetMGM and Caesars, competing for the third spot in the market, decide in response? DraftKings’ decision sets a precedent that has the potential to reshape the markets in several states with the highest tax rates, and in the future, possibly across the entire United States.

Recommended