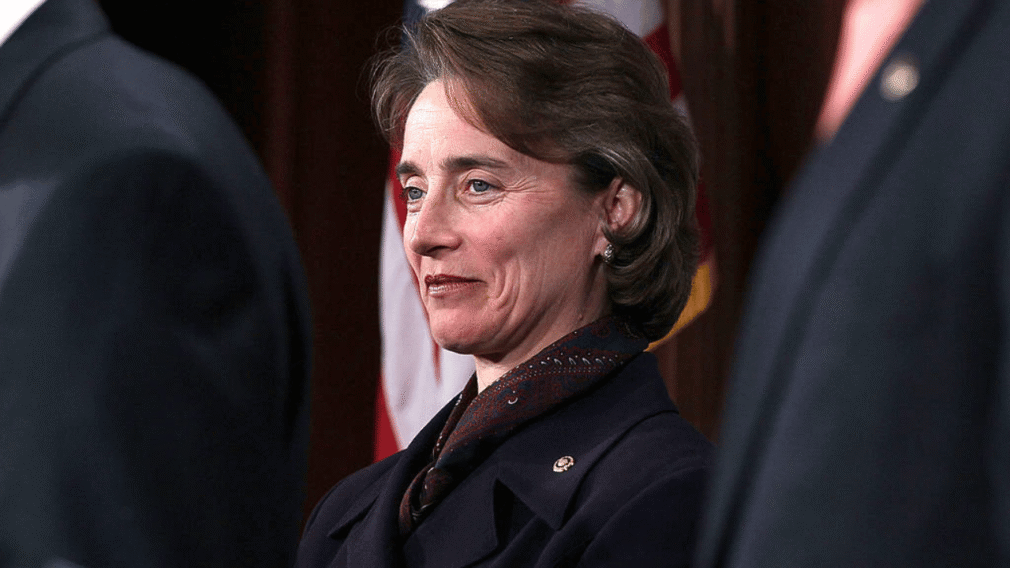

Blanche Lincoln Defends CFTC’s Grip on Prediction Markets

Former U.S. Senator Blanche Lincoln, co-author of Dodd-Frank, insists the CFTC should solely regulate prediction markets. State bans threaten federal oversight, she warns.

Lincoln’s Call for Federal Control

Blanche Lincoln, now lobbying for Kalshi, urged the Commodity Futures Trading Commission (CFTC) to assert its “exclusive jurisdiction over all prediction markets,” including sports-related ones.

She argues only the CFTC can decide which futures contracts to ban, applying consistent rules. “We should not open up our regulatory structure to a chaotic system where states and other jurisdictions reject contracts at will,” Lincoln said, calling state interference a “grave mistake.”

Nevada, New Jersey, and Maryland have issued cease-and-desist orders against Kalshi, claiming its markets mimic traditional sports betting and violate state gambling laws.

Lincoln sees these moves as undermining the federal oversight she helped craft through Dodd-Frank. She warns that state blocks on sports-based prediction markets could set a “damaging precedent,” allowing states to reject any contract type, disrupting the U.S. futures industry.

A Shift in Perspective

In 2010, Lincoln argued sports-based contracts “would not serve any real commercial purpose” and were “solely for gambling.” By 2025, she flipped, stating events like the Super Bowl hold “strong commercial value” due to their impact on ads, apparel sales, and hospitality. Critics have pounced on this reversal, questioning her motives as a Kalshi advocate.

Lincoln claims Dodd-Frank allows the CFTC to ban contracts only if they lack commercial utility. However, the law actually permits bans for contracts against the public interest, even if commercially useful.

This discrepancy fuels debate over whether prediction markets, especially sports-related ones, should fall under CFTC or state gambling regulations.

Recommended