AGA’s 2025 Outlook Reveals Q1 Gaming Contraction but Long-Term Hope

The American Gaming Association’s May 13, 2025, Gaming Industry Outlook reports a sharp Q1 economic dip in the US gaming sector, tempered by cautious executive optimism for the future.

A Rough Start to 2025

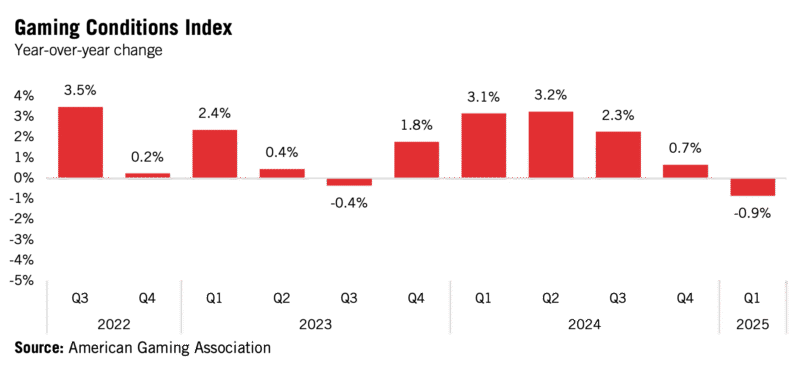

The US gaming industry hit a rough patch in Q1 2025, with real economic activity dropping 0.9% year-over-year, the steepest decline since the pandemic, according to the American Gaming Association’s (AGA) Gaming Industry Outlook released May 13.

“Economic uncertainty’s impacting capital spending,” one executive noted, as tariffs and stock market dips sour consumer spending.

Despite the gloom, gaming executives see brighter days ahead, with 46% expecting revenue growth in the next six to 12 months.

The AGA’s Gaming Conditions Index (GCI) paints a stark picture, showing a 0.9% contraction in Q1 2025, driven by weaker real wages, sluggish revenue growth, and slightly negative executive sentiment.

“Real economic activity fell at the fastest rate since the pandemic,” the AGA reported, with inflation-adjusted gaming revenue and wages dragging the index down.

Casino hotel event requests for proposals (RFPs) held steady, up 0.3% from last year, but couldn’t offset the broader decline. The GCI, tracking revenue, employment, wages, sentiment, and RFPs, signals a tough quarter, though not a full recession, as the industry digests tariff shocks and market volatility.

Executive Sentiment: Glass Half Empty, Half Full

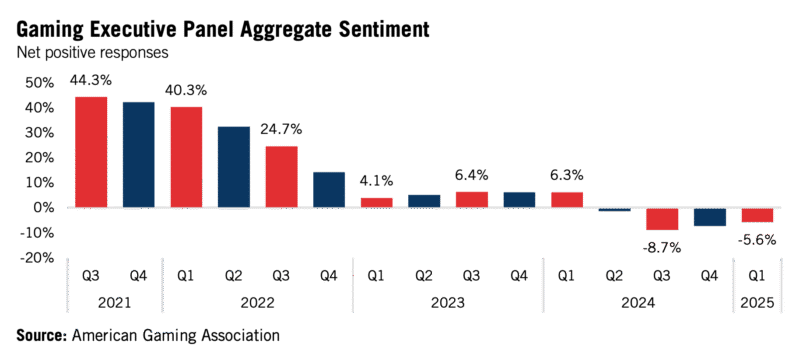

Gaming executives are feeling the pinch, with sentiment at -5.6% in Q1 2025, meaning more negative than positive responses on business conditions, revenue, and customer activity.

“Maintaining margins in an uncertain economic environment” is a top worry, with 36% rating the current business situation negatively, a first since AGA’s surveys began in 2021.

Yet, sentiment improved slightly from Q3 2024, and long-term optimism shines through: 82% see a neutral future, 14% positive. Capital investment looks solid, with 41% expecting an uptick, targeting hotels and dining, though hiring and wage growth stay muted.

Economic Headwinds: Tariffs and Market Woes

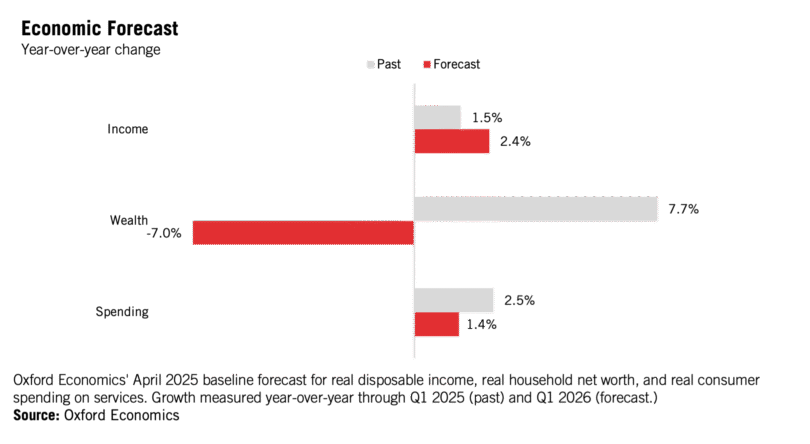

The broader economy’s throwing curveballs. Oxford Economics predicts a 3.6% consumer price index rise in 2025, up from 3.0%, fueled by tariffs and supply chain stress.

“The impact of tariffs on supply chain” worries executives, with household wealth expected to drop 7.0% and service spending slowing to 1.4%. Stock market declines are curbing discretionary spending, hitting gaming’s vibe.

Still, no recession’s forecast, and real disposable income should grow 2.4% by Q1 2026, offering a lifeline. The AGA notes 56% of executives cite economic uncertainty and inflation as top concerns, up from 28% last quarter.

Despite the Q1 slump, the AGA’s outlook isn’t all doom. Casino hotel RFPs remain above pre-pandemic levels, and 29% of executives expect customer activity to rise, the highest since Q2 2022.

“We’re pivoting due to lack of mobile sports betting expansion,” one executive said, hinting at strategic shifts. Suppliers are bullish, with gaming equipment makers upbeat on sales for new and replacement units.

Recommended