iGaming Weekly Recap (March 3–9, 2025): Nevada Shakes Up Prediction Markets

Last week kept the industry buzzing with more prediction market chaos, spotlighting Nevada and tribal leaders. On top of that, Flutter Entertainment rolled out its latest quarterly financials, while BetMGM announced staff cuts in New Jersey. Stay in the loop and check out our newest Weekly Recap!

Flutter Entertainment shared its financial report last week, showing FanDuel’s 2024 revenue hit $5.8 billion. The company stayed on top in U.S. online sports betting with a 44% market share. Its iGaming revenue climbed 46% to $1.524 billion, grabbing a 25% share and the number-one spot.

In Q4, FanDuel held a 43% share in sports betting and 26% in iGaming. Total U.S. revenue for Flutter was up 32% from last year. For 2025, they’re forecasting a 13% revenue increase and a 34% jump in adjusted EBITDA, mostly thanks to FanDuel.

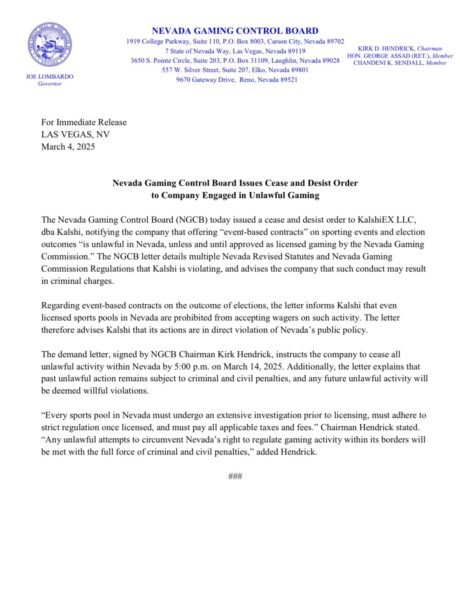

Nevada has ordered Kalshi, a prediction market platform, to cease operations in the state by March 14, 2025. The issue? Offering contracts on sports events and elections without a proper gambling license, breaking state law. The Nevada Gaming Control Board (NGCB) says penalties are on the table if Kalshi keeps pushing the rules (more in the bonus section).

The Kalshi mess in Nevada isn’t the only headache for prediction markets. Tribal leaders are also speaking out, saying these platforms threaten their exclusive gaming rights. Meanwhile, the American Gaming Association (AGA) has its own concerns and wants a seat at the table for an upcoming roundtable discussion. Rep. Dina Titus recently warned that prediction markets could be a “back door” to sports betting in some states. Those behind the markets are pushing back, calling them a 21st-century tool for understanding the world.

A push to legalize sports betting in Georgia is gaining traction, laid out in a two-phase approach. Step one: amend the state constitution, needing legislative approval and a voter green light in 2026. Step two: a bill setting up to 16 online betting licenses, some tied to sports teams. It slaps a 24% tax on revenue, mostly funding the HOPE scholarship and pre-K programs, with a chunk for addiction support. Licenses split between the state lottery, sports teams, and open bids, with hefty fees and a ban on college event wagers rounding out the deal.

BetMGM is trimming 83 positions at its Jersey City HQ as the sports betting boom cools off. Facing stiff competition from FanDuel and DraftKings, plus pressure to boost profitability, the company’s making moves. The layoffs aim to streamline operations and cut costs, setting up a stronger financial picture by 2025. BetMGM’s also shifting gears, doubling down on online casinos while chasing long-term growth in both iGaming and sports betting. Proposed tax hikes in New Jersey are adding extra heat to the decision.

Bonus: Nevada Shakes Up Prediction Markets

It’s 2025, and we’re used to weekly game-changers in the prediction market space. This time, it’s the Nevada Gaming Control Board (NGCB) stirring the pot, as it slapped Kalshi with a cease-and-desist letter, marking the first real roadblock since the platform’s popularity surged last fall.

Until now, Kalshi’s ride has been smooth: Donald Trump’s White House comeback, Don Jr. joining as a strategic advisor, and hints of a softer CFTC stance. Day by day, they’ve expanded into sports events, even tossing around the bold “Bet on Anything” tagline, that really suggests sky-high confidence.

The CFTC’s gearing up for a roundtable to hash out its take on prediction markets, but with Kalshi board member Brian Quintenz tapped to lead the agency, alongside Don Jr.’s influence, things looked cozy for the company.

Then Nevada broke the silence. The NGCB’s letter demands Kalshi halt operations in the state by March 14, throwing a wrench into the works.

Kalshi’s response so far?

A statement to The Closing Line says they’re “disappointed” but respect regulators:

“While we’re disappointed with the Commission’s assessment, Kalshi has always held the utmost respect for regulators and the regulatory process. We’ve been a federally regulated exchange for over four years and a federally regulated clearinghouse for about six months. We are proud to have paved the way for prediction markets to thrive in the U.S. We look forward to a swift resolution to this matter and to ensuring that Americans continue to have access to safe, regulated, and transparent prediction markets.”

CEO Tarek Mansour doubled down on LinkedIn, admitting not everyone’s sold on prediction markets yet:

“After the election, we were convinced that the value of prediction markets was now obvious to everyone, and that the regulatory battle for legal prediction markets was over… We were right, except for the everyone part. While we are disappointed to see the letter from the Nevada Gaming Commission, Kalshi will stay committed to our approach and keep paving the way for regulated prediction markets to thrive in the US.”

What matters most is how Kalshi responds, not just its words. Shutting down in Nevada might trigger other states to follow suit. Ignoring the order, though, puts the ball back in Nevada’s court to either enforce it or let it slide.

It’s a big moment either way. The CFTC’s position won’t clear up before March 14, and so far Kalshi has been charging full speed ahead. Will they stick to that approach now?

Recommended