PENN Entertainment Shows Growth Despite Challenges in 2024 Financial Report

PENN Entertainment has released its financial results for 2024, revealing a mixed performance with notable revenue growth alongside continued challenges in its interactive segment.

2024 Financial Highlights

PENN Entertainment reported annual revenue of $6.58 billion for 2024, a 3.4% increase from the previous year’s $6.36 billion. Despite this growth, the company posted a net loss of $313.3 million for the year, though this marks a substantial improvement compared to the $491.4 million loss recorded in 2023.

For the fourth quarter specifically, PENN generated $1.669 billion in total revenue, slightly beating analyst expectations of $1.67 billion. The company reduced its quarterly net loss to $133.8 million, down from the $358.8 million loss in the same period of 2023.

The company maintains a strong liquidity position with $1.7 billion in total liquidity as of December 31, 2024, including $706.6 million in cash and cash equivalents.

Property-Based vs. Digital Performance

PENN’s brick-and-mortar operations delivered solid results, with property-level revenues reaching $1.4 billion in the fourth quarter. Physical locations generated an adjusted EBITDAR of $461.2 million with an impressive 33.1% margin.

CEO Jay Snowden highlighted this success, noting: “PENN’s fourth quarter property-level operating results reflect solid performance, as properties not impacted by new supply generated nearly 3% year-over-year revenue growth.”

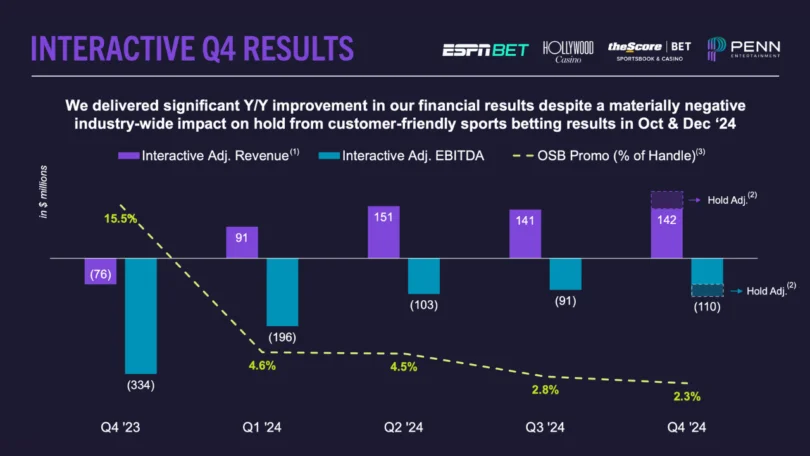

In contrast, the interactive segment, covering online casinos and sports betting, has faced more significant hurdles. While this division brought in $275 million in fourth-quarter revenue, it recorded an adjusted EBITDA loss of $109.8 million.

However, Snowden emphasized that this represents “significant year-over-year improvements in revenue and Adjusted EBITDA driven by our disciplined promotional strategies and accelerated growth in our online Casino business.”

ESPN BET Performance and Strategy

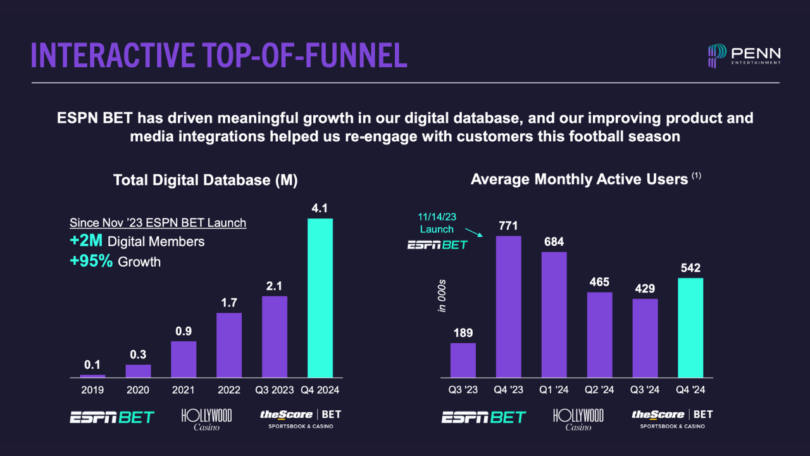

The ESPN BET platform, launched in November 2023, has become a central element of PENN’s digital strategy. The platform has added over 2 million new members since its launch, significantly expanding the company’s digital customer base.

PENN has reported growing traction with parlay bets, which now account for over 30% of all wagers placed in December and January. The Same Game Parlay (SGP) feature has been particularly successful in driving this growth.

To enhance the ESPN BET experience, PENN plans to introduce live streaming within the app and integrate with the Men’s NCAA Tournament Challenge. The company has also expanded its retail presence, increasing the total number of ESPN BET retail locations to 18.

iCasino Growth

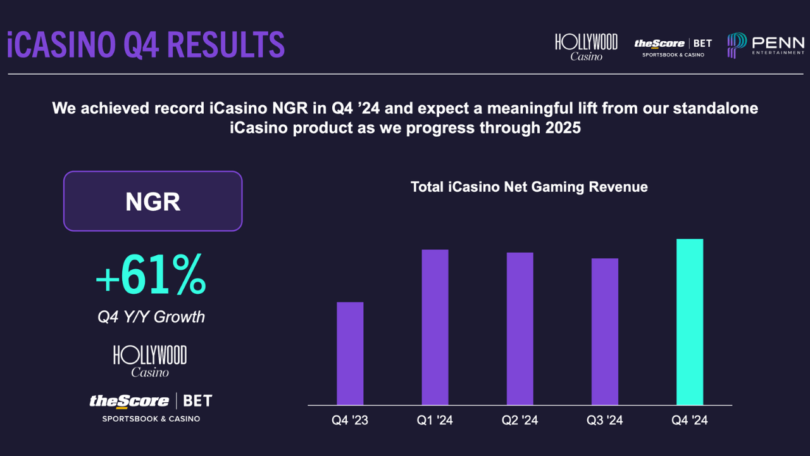

A bright spot in PENN’s interactive segment has been its online casino business, which achieved record quarterly revenue with over 60% year-over-year growth.

The company successfully launched standalone Hollywood Casino apps in Pennsylvania and Michigan, with the app ranking second among U.S. iCasino products according to Eilers & Krejcik.

Snowden expressed enthusiasm about this development: “The success in our iCasino business is bolstered by the continued strong momentum from the recent launches of our standalone Hollywood Casino app in Pennsylvania and Michigan.”

Strategic Initiatives and Future Outlook

PENN Entertainment is actively pursuing several strategic initiatives to drive future growth:

- Retail Development Projects: Four retail development projects are progressing on budget and schedule, including the planned opening of Hollywood Casino in Joliet in Q4 2025, the relocation of Hollywood Aurora in early 2026, and construction of a hotel tower at Hollywood Columbus.

- Omnichannel Strategy: The company reported a 64% year-over-year increase in customers transitioning from online to retail locations, supporting its omnichannel approach. Market share increased in 16 of 19 regional markets during Q4.

- Shareholder Value: PENN has announced plans to repurchase at least $350 million in shares during 2025, potentially in response to pressure from activist investor H G Vora Capital Management, which has indicated its intention to nominate three candidates to the Board of Directors.

- 2025 Forecast: The company projects 2025 revenue between $1.01 billion and $1.08 billion, with adjusted EBITDA expected to range from $115 million to $135 million—representing a 35% increase compared to 2024.

Looking ahead, Snowden stated, “We are excited by the opportunities that lie in front of us in 2025 and into 2026 in all aspects of our business.”

While PENN Entertainment continues to face challenges in certain segments, particularly in achieving profitability within its interactive division, the company’s diversified approach across physical and digital gambling platforms appears to be positioning it for potential growth in the coming years.

Recommended