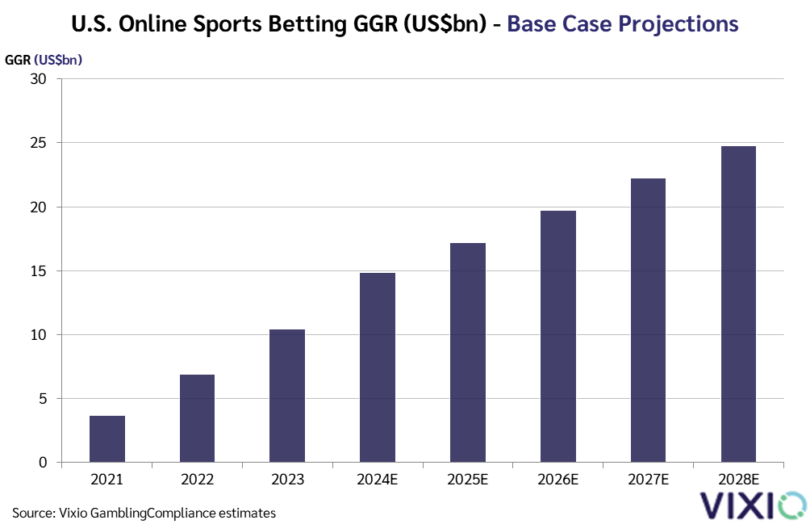

VIXIO Forecasts U.S. Online Sports Betting Market to Reach $17.2 Billion in 2025

The U.S. sports betting and iGaming market is on a trajectory for great expansion, with VIXIO forecasting $17.2 billion in online sports betting revenue by 2025.

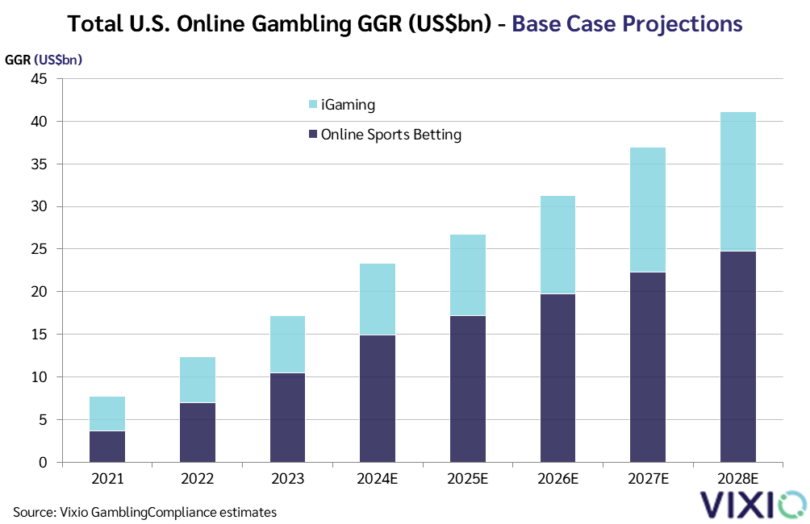

Despite the optimistic growth outlook, regulatory challenges, tax pressures, and legislative uncertainties remain critical factors that could shape the industry’s future. By 2028, the total market, including iGaming, could surpass $41 billion under a baseline scenario or reach as high as $54.4 billion in a more aggressive expansion model.

Regulatory Challenges and Legislative Uncertainty

VIXIO’s report emphasizes that 2025 will be more about regulatory scrutiny than new market expansions. Instead of rapid legalization in new states, the industry will likely face increased oversight at both the state and federal levels. This shift follows growing concerns from lawmakers, sports leagues, and regulators about problem gambling, betting integrity, and the rise of unregulated sweepstakes platforms.

One major area of focus is responsible gaming, with several states exploring stricter measures to curb problem gambling. Regulators could implement policies similar to those in Europe, such as mandatory deposit limits, cooling-off periods, and more robust self-exclusion programs. Another growing concern is betting integrity, especially after multiple scandals involving athletes violating sports betting policies.

To counteract this, sports leagues and regulators may introduce new restrictions on player-related wagers, such as banning certain prop bets or limiting betting options on college sports.

Enforcement actions are also expected to intensify. Regulators have already become more aggressive in fining operators for compliance failures, and this trend is likely to continue throughout 2025. At the same time, offshore betting operators face increasing scrutiny, with some states issuing cease-and-desist orders to unauthorized sportsbooks operating in their jurisdictions.

Another potential regulatory shake-up concerns sweepstakes platforms, which offer sports betting-style contests without a formal gambling license. Some states may attempt to ban or heavily regulate these platforms, arguing that they exploit legal loopholes. Additionally, the legal definition of fantasy sports could be revised, impacting platforms that blur the line between traditional fantasy contests and real-money wagering.

Tax Increases Could Reshape the Market

While regulatory concerns dominate headlines, VIXIO also warns of impending tax hikes on sports betting revenues. Several states are considering raising taxes on sportsbooks as a way to generate additional revenue without increasing general taxes on residents. This could present challenges for operators, as higher tax rates could squeeze profit margins and lead to changes in the way sportsbooks offer promotions and odds.

States that originally set low tax rates in 2018 and 2019 are particularly likely to reconsider their approach. Additionally, high-revenue states like New York, Pennsylvania, and Illinois could increase their rates, as operators are unlikely to withdraw from such lucrative markets even if tax burdens rise.

For states struggling with budget deficits, sports betting offers an easy target for tax hikes. Lawmakers view it as a politically safe option, since raising gaming taxes rarely triggers public opposition. Operators, however, may push back by lobbying for online casino legalization in exchange for accepting higher sports betting tax rates.

The Growing Role of iGaming in Market Expansion

As sports betting faces rising taxes and regulatory hurdles, many operators see iGaming as the key to long-term profitability. VIXIO projects that online casino gaming revenue will grow from $9.6 billion in 2025 to over $16.2 billion by 2028, surpassing sports betting as the industry’s primary driver of revenue.

New Jersey, Pennsylvania, and Michigan have already demonstrated how iGaming can deliver high margins, with each state reporting over $2 billion in annual gross gaming revenue.

As a result, sportsbook operators are pushing for iGaming legalization in new states, arguing that regulated online casino games can generate significant tax revenue while providing a safer alternative to offshore sites.

New York Leads the Way in Sports Betting Revenue

Despite the broader market trends, New York remains the most dominant sports betting market. In November 2024, the state recorded a 53.5% increase in gross revenue, setting a new record at $232.2 million. This surge came despite a slowdown in total betting volume.

Other key states like Florida, Illinois, and Ohio are expected to follow New York’s lead, with each projected to surpass $1 billion in annual revenue by 2028. However, tax increases, regulatory shifts, and competition from iGaming could impact long-term growth trajectories.

While VIXIO’s forecast for the U.S. sports betting and iGaming industry remains optimistic, 2025 will bring increased regulatory scrutiny and tax pressures. Lawmakers and regulators are shifting their focus from expanding legalization to tightening oversight, which could reshape the way operators do business.

Despite these challenges, the industry’s long-term outlook remains strong. By 2028, online sports betting revenue could reach up to $29 billion, and iGaming could push total market revenue beyond $54 billion.

Recommended