Robinhood Enters Election Betting Market

Robinhood has announced its entry into the election betting markets, joining other firms like Interactive Brokers and Kalshi by offering contracts based on the outcomes of elections. This innovative form of trading is considered a new asset class, particularly in the context of event derivatives trading. Despite ongoing controversies and legal actions from the Commodity Futures Trading Commission (CFTC), this market segment is experiencing rapid growth as the 2024 presidential election approaches.

Robinhood’s Approach to Election Betting Markets

Through its subsidiary Robinhood Derivatives and the ForecastEx platform, managed by Interactive Brokers, Robinhood will offer clients event-based futures contracts specifically focused on the 2024 presidential election. These derivatives, known as event contracts, enable traders to speculate on the outcome of specific events. In this case, users can place bets on whether Kamala Harris or Donald Trump will win the election.

To participate, Robinhood customers must be U.S. citizens with an approved Robinhood Derivatives account and meet certain criteria, including margin approval and options trading at level 2 or 3. Harris/Trump contracts on Robinhood are priced between two and 99 cents per share, capped at $1 per share. Users can purchase up to 5,000 election contracts.

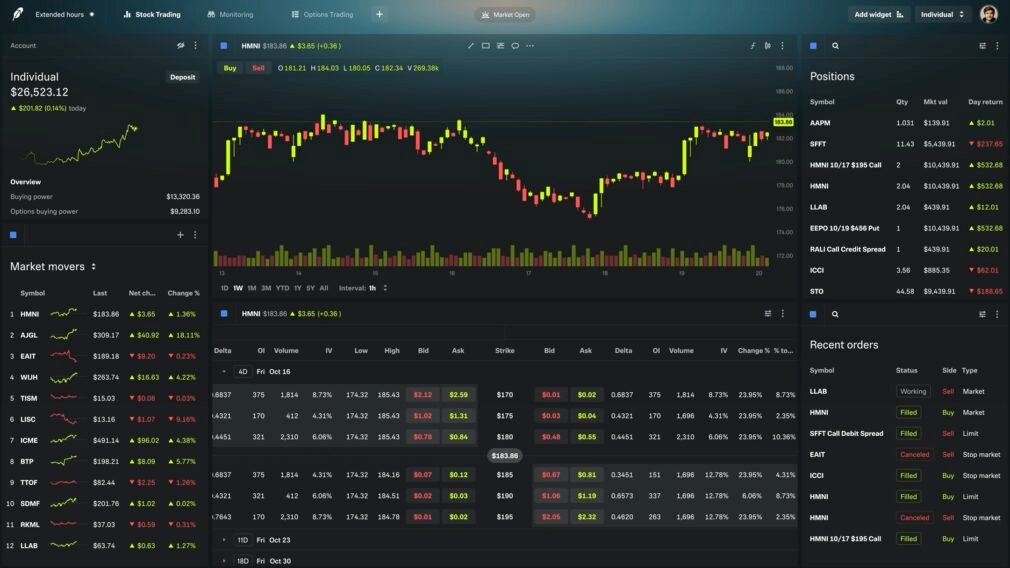

Robinhood’s platform allows for real-time decision making through event contracts, enabling investors to make informed choices as the situation develops.

By introducing these election betting options, Robinhood positions itself alongside investment platforms such as Interactive Brokers and Kalshi, both of which offer similar election-related contracts. While the CFTC aims to restrict this type of trading, the issue is unlikely to be resolved before the upcoming election.

Robinhood platform boasts over 24.2 million funded accounts, with 11.8 million considered active monthly users. Known for its appeal among Millennials and Gen Z, Robinhood’s expansion into election betting could bring widespread attention to this market segment.

Robinhood’s Election Betting Platform

Robinhood’s election betting platform offers an opportunity for users to engage in election outcome trading for the 2024 presidential election. Through this platform, users can trade event contracts on whether Kamala Harris or Donald Trump will win.

Each contract is priced between two cents and 99 cents, with the potential for a payout of up to $5,000 if the prediction is correct. Users can purchase up to 5,000 contracts, allowing for significant investment in their predictions.

Trading on Robinhood’s platform is nearly continuous during the election week, with a brief 15-minute no-trading period at 5 p.m. ET each day.

This near-24/7 trading window ensures that users can make real-time decisions based on the latest developments. The contracts will pay out on January 7-8, 2025, providing a clear timeline for users to see the results of their investments.

Election Betting Odds vs. Polling: Key Differences

Unlike traditional polling, which relies on public opinion data collected from a representative sample of voters, Robinhood’s model offers “event contracts” that fluctuate based on the predicted outcome of an event. While polling aims to gauge voter sentiment and predict likely outcomes, Robinhood’s contracts act as a market-driven mechanism where users actively buy and sell shares based on who they believe will win.

A single trader operated four accounts on a betting platform, collectively wagering more than $28 million on a Trump contract for the upcoming presidential election.

Rather than conducting surveys, Robinhood functions as a marketplace that reflects crowd wisdom. The price of each contract mirrors the collective perception of Robinhood’s user base, providing an alternative perspective to conventional polling by focusing on trading sentiment over public opinion data.

Betting Odds and Trends

As the 2024 presidential election approaches, betting odds are becoming a focal point for those looking to predict the outcome. Currently, the odds favor Donald Trump, with BetMGM UK listing him at -192, translating to an implied probability of 62.18%. In contrast, Vice President Kamala Harris has odds of +150, giving her an implied probability of 37.82%, according to Action Network.

These odds reflect the broader public sentiment and historical voting patterns. While many states have a clear favorite based on past elections, the seven swing states present a more competitive landscape.

For instance, Trump has the highest betting odds in states like Mississippi, South Dakota, Tennessee, and Wyoming. On the other hand, Harris’s strongest odds are in Vermont and Maryland.

Former President Donald Trump’s Chances

In the betting markets, former President Donald Trump is currently the favored candidate to win the 2024 presidential election. With odds of -192 at BetMGM UK, Trump’s implied probability of victory stands at 62.18%.

His campaign has been heavily focused on economic issues, with Trump advocating for tax cuts and criticizing the Biden-Harris administration’s economic policies.

Trump’s supporters view these favorable odds as a sign of growing support for his candidacy. They argue that his economic plans resonate with voters concerned about the current administration’s handling of the economy.

However, it’s important to remember that betting markets are not always accurate predictors of election outcomes. The 2024 presidential election is expected to be a close race, and many factors could influence the final result.

Recommended