Fanatics and Polymarket Launch US Prediction Platforms

December 3, established a new baseline for the prediction market industry in the United States. Two major entities, Fanatics and Polymarket, executed simultaneous entries into the sector. Fanatics introduced a brand-new platform to leverage its existing sports database, while Polymarket returned to American soil after a regulatory hiatus.

Fanatics Markets Initiates Multi-State Rollout

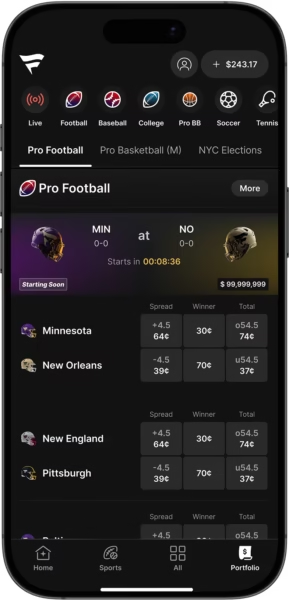

Fanatics debuted its dedicated platform, Fanatics Markets, with an aggressive rollout schedule covering 24 states within three days.

The launch began on Wednesday in ten locations, including Alaska, Delaware, and New Hampshire.

The expansion continues Thursday with nine additional states, such as Minnesota and Oregon.

The strategy culminates on Friday with access opening in major commercial hubs, including California, Florida, Texas, and Washington.

The platform integrates directly with the broader Fanatics ecosystem. Users benefit from a shared wallet system, allowing funds to move between the prediction market and other Fanatics services.

Crypto.com serves as the technology partner responsible for providing pricing data. The initial catalog features contracts on sports, finance, and economics. Management plans to add categories for cryptocurrencies, equities, and music in early 2026.

Matt King, CEO of Fanatics Betting and Gaming, dismissed concerns regarding the company’s timing relative to early movers like Kalshi. He described the current environment as the “top of the first inning,” predicting exponential growth over the next decade.

King emphasized that the product serves as a logical extension for sports fans who want to “engage with the moments that move sports and culture.”

Polymarket Returns After Regulatory Pivot

Polymarket simultaneously announced its reentry into the US market. This return follows a four-year absence triggered by a 2022 settlement with the Commodity Futures Trading Commission (CFTC).

The company circumvented a lengthy registration process by acquiring the CFTC-registered exchange QCEX in July for $112 million.

This acquisition, combined with a “no-action letter” received in September, provided the legal framework for operations to resume.

The platform is currently accessible via a waitlist model, with invitations distributed on a rolling basis. In a shift from its global offering, the US application focuses exclusively on sports contracts during the initial phase.

The company stated that “markets on everything else” will follow. This “sports-first” approach aligns the product with American consumer interests while navigating the complex regulatory environment.

Pressure Mounts on Legacy Operators

The arrival of Fanatics and the return of Polymarket create immediate pressure on established sportsbook operators.

The rapid adoption of event contracts suggests that prediction markets function as a complementary product to traditional sports betting rather than a distant alternative.

Industry observers expect FanDuel and DraftKings to accelerate their own timelines in response. Both operators have monitored the sector closely, but the aggressive entry of a direct competitor like Fanatics forces the issue.

Recommended