Kalshi Secures $1 Billion at $11 Billion Valuation

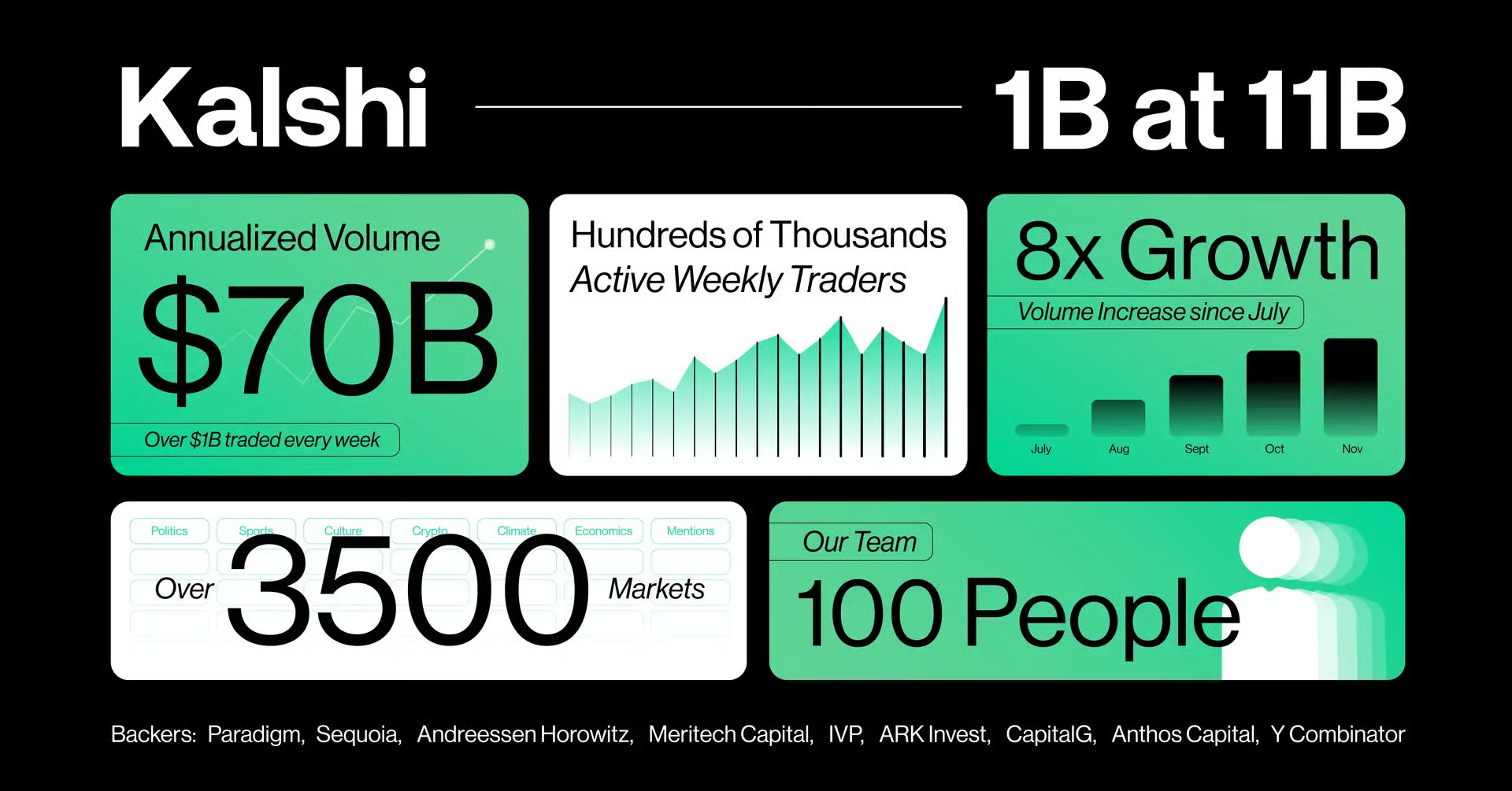

Kalshi closed another massive funding round. The regulated exchange raised $1 billion in fresh capital, pushing its total valuation to $11 billion. Paradigm led the investment, marking the company’s third major capital injection within a single year.

A Year of Exponential Financial Growth

The valuation jump represents a steep trajectory for the company. Only two months prior, in October 2025, investors valued Kalshi at $5 billion during a $300 million Series D round.

Going back further to June, the company held a $2 billion valuation. The leap to $11 billion shows the intense demand from venture capital firms to secure a stake in the prediction market infrastructure.

Paradigm, a firm that had invested previously, led the December round. They were joined by a roster of prominent Silicon Valley backers, including Sequoia Capital, Andreessen Horowitz, Meritech Capital, and Y Combinator. Other participants included IVP, ARK Invest, Anthos Capital, and CapitalG.

Matt Huang, co-founder and managing partner at Paradigm, commented on the platform’s velocity in an interview with The New York Times:

“It’s one of the fastest-growing companies we’ve ever seen.”

This financial event also altered the personal fortunes of the company’s founders. Tarek Mansour and Luana Lopes Lara, who retain an estimated 20% to 25% ownership stake, are now paper billionaires.

Strategy and Market Expansion

CEO Tarek Mansour indicated that the capital will fund specific operational goals rather than general corporate runway. The primary objective is global expansion and the development of new trading products.

A central part of this strategy involves distribution deals with traditional brokerages. Kalshi aims to integrate its contracts into standard investment accounts, allowing users to trade event outcomes as easily as they trade stocks.

The push for scale comes as the platform sees record activity. Driven largely by the popularity of sports parlay contracts, Kalshi reported a trading volume of approximately $5.8 billion in November alone.

This figure represented a 32% increase compared to October’s performance.

Mansour addressed the company’s ambition to The New York Times:

“We’re in a massive market with a massive opportunity. We have to scale up to rise to that opportunity.”

On LinkedIn, Mansour contextualized the raise within the broader history of the industry:

“Kalshi raised $1B at an $11B valuation. A decade ago, only a few thousand people knew what a prediction market was. Eighteen months ago, most prediction markets were banned – until we overcame the government to set them free. Over the past seven years, our community has opened up an entirely new category.”

The Arms Race with Polymarket

This funding round is part of a larger battle for dominance between Kalshi and its offshore rival, Polymarket. Both entities spent 2025 accumulating war chests that dwarf the early funding rounds of traditional sports betting giants like DraftKings or FanDuel.

Polymarket has also attracted significant institutional capital. In October 2025, the platform raised roughly $2 billion from the Intercontinental Exchange (ICE), the owner of the New York Stock Exchange.

That deal valued Polymarket at $8 billion. While Polymarket historically focused on cryptocurrency-based operations offshore, it has recently moved to acquire regulated entities, such as QCEX, to enter the U.S. market legally.

Investors are effectively betting on which model will capture the majority of the global volume: Kalshi’s federally regulated, bank-integrated approach or Polymarket’s crypto-native roots backed by traditional financial data giants.

Mansour summarized the cultural shift driving this competition:

“Today, Kalshi is trusted, used, and loved by millions of people. It’s a part of everyday culture, and it’s driving one of the most important shifts in consumer behavior in recent history. The time has finally come for prediction markets to achieve their full potential and we are intent on making that happen.”

Recommended