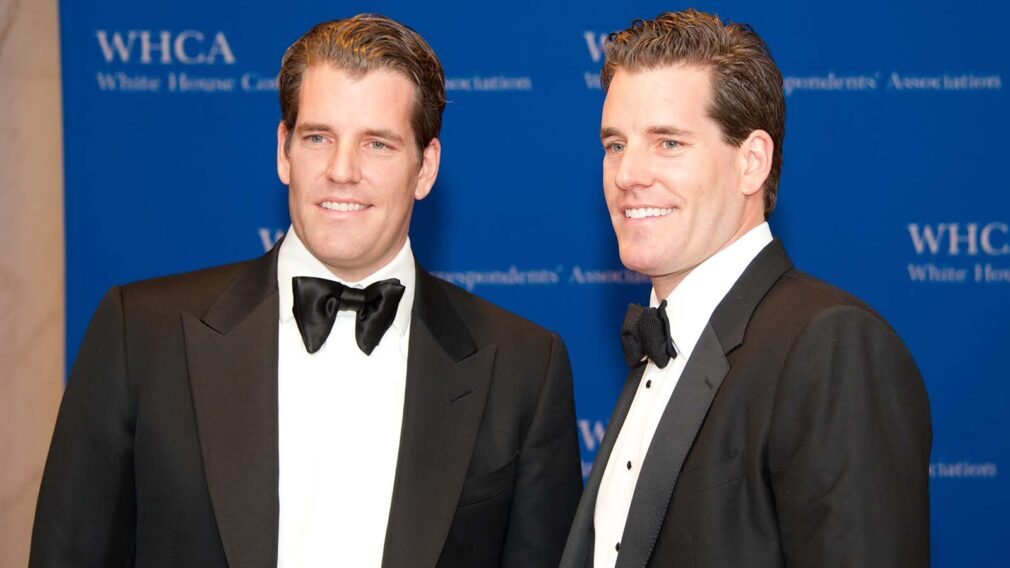

Winklevoss Twins’ Gemini Pushes Into Prediction Markets

The Winklevoss twins, through their exchange Gemini Space Station Inc., are moving to enter the prediction market contract segment. According to a Bloomberg report, the firm is seeking regulatory approval to launch its own derivatives exchange to trade contracts based on event outcomes.

Seeking Regulatory Path for Regulated Betting

Gemini is pursuing a federal regulatory framework to offer event contracts that allow for regulated wagering on the results of elections, sporting events, and other outcomes. The company previously disclosed its goal to launch contracts tied to “economic, financial, political, and sports forecasts” ahead of its planned Initial Public Offering (IPO).

To facilitate this, Gemini filed an application with regulators to create its own designated contract market, which is a type of derivatives exchange. As of May, this application was still pending review.

The process to secure approval for a new exchange from the U.S. Commodity Futures Trading Commission (CFTC) can be lengthy, potentially taking months or even years. Regulatory uncertainty, including possible government shutdowns, could lead to delays in the approval process.

Entering a Competitive Market

Gemini’s decision to launch its own exchange immediately places it in competition with dominant firms already operating in the nascent prediction market industry:

- Kalshi, which is already registered with the U.S. derivatives regulator, has seen record volumes.

- Polymarket also aims to resume operations in the U.S. soon.

Larger, traditional finance players are also making moves in this area, including Intercontinental Exchange Inc. and CME Group Inc. Furthermore, cryptocurrency rivals like Coinbase Global Inc. have announced plans to expand into event contracts as part of their strategy to become an “Everything Exchange” for financial products.

Some firms, like Robinhood, have taken an alternative path, choosing to partner with existing licensed platforms such as Kalshi to offer event contracts to their clients instead of building their own exchange from scratch.

Recommended