Kalshi Launches IPO Prediction Markets

Prediction market Kalshi has launched a new set of event contracts that allow retail traders to bet on the outcomes of Initial Public Offerings (IPOs). The move gives everyday investors a new way to gain exposure to the often-exclusive IPO market without needing to buy shares directly.

Betting on the Biggest Names in Tech

The new offering includes a series of markets that ask a simple question: Will a specific company officially announce an IPO before January 1, 2026? The list of companies is a who’s who of the tech world’s most anticipated public offerings, including giants like SpaceX, OpenAI, Stripe, and Discord.

These contracts provide a unique way for traders to speculate on the future of these major private companies. A “Yes” contract pays out if the company’s IPO is confirmed, which happens when the SEC declares its S-1 filing effective, a price is set, or a stock ticker is assigned.

The new markets are already providing a real-time sentiment gauge on which companies are most likely to go public. According to Kalshi’s traders, the Swedish fintech giant Klarna is the clear frontrunner, with the market giving it an 80% chance of an IPO before the 2026 deadline.

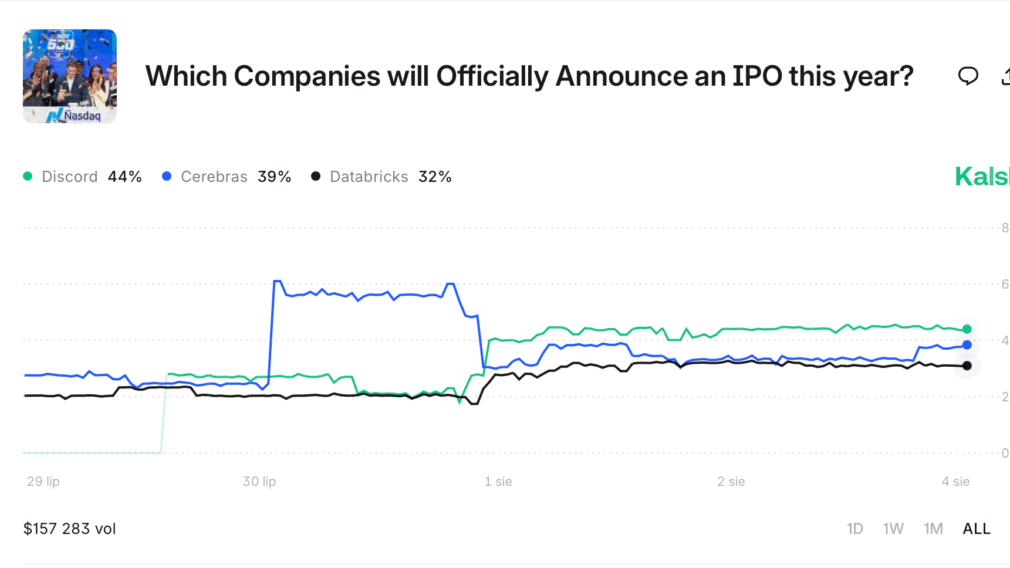

Other companies with strong odds include the social platform Discord at 45%, the AI chipmaker Cerebras at 39%, and the data and AI company Databricks at 33%.

At the other end of the spectrum, some of the biggest names in AI, like OpenAI (6%) and Elon Musk’s xAI (5%), are seen as long shots to go public in the next year and a half.

Democratizing IPO Access

The launch of these new markets is a direct response to the frustration many retail investors feel about their limited access to IPOs. Kalshi’s move was spurred by the recent highly successful IPO of the design software company Figma, which saw its stock soar 250% from its listing price.

For most retail investors, getting an allocation of shares in a hot IPO is nearly impossible. Kalshi’s contracts provide an alternative, allowing them to speculate on post-IPO metrics like closing prices or valuation milestones. This effectively democratizes access to the IPO event, even if it doesn’t provide direct ownership of the stock.

The move into IPOs is a significant expansion for Kalshi and the broader prediction market space. It takes the platform beyond its traditional focus on politics and economics and into the heart of the financial markets.

Recommended