U.S. Bettors Outspend but Trail in Loyalty, Optimove Report Reveals

U.S. bettors are dropping big cash compared to global players, but lag in engagement and loyalty, per the Optimove US Gaming Pulse Report for April 2025.

A Spending Powerhouse

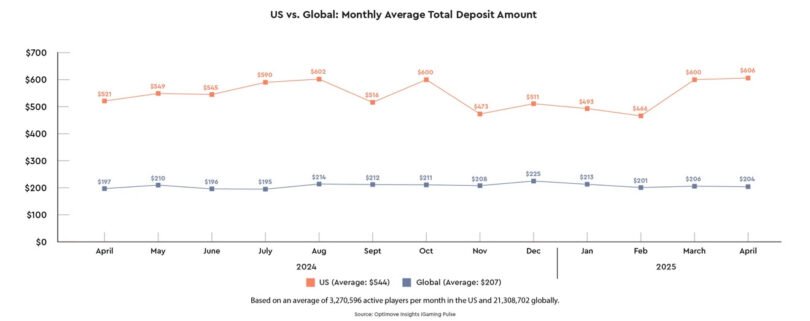

U.S. bettors are outspending their global counterparts by a wide margin, according to the Optimove US Gaming Pulse Report for April 2025, which crunched data from 3.2 million U.S. and 21.3 million global players.

In April, U.S. players deposited an average of $606, nearly triple the global average of $204, marking a 16% year-over-year jump. This spending spree, averaging $544 over the past 12 months, reflects a hot U.S. market fueled by expanding legalization, like Missouri’s recent betting launch.

But while the U.S. leads in cash flow, it’s playing catch-up in keeping players hooked, sparking buzz about how operators can sustain this growth.

Casino Betting Booms

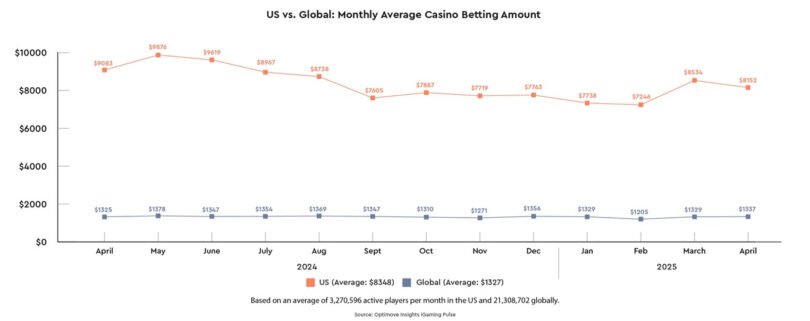

The U.S. casino scene is on fire, with bettors averaging $8,152 per month in April 2025, a staggering 6.1 times the global average of $1,337.

Over the past year, U.S. casino bets averaged $8,348, dwarfing the global $1,327, driven by states like Rhode Island, which legalized iGaming in March 2024.

Player growth is equally impressive, with a 30% year-over-year surge in U.S. casino bettors by April, compared to a 12% global rise.

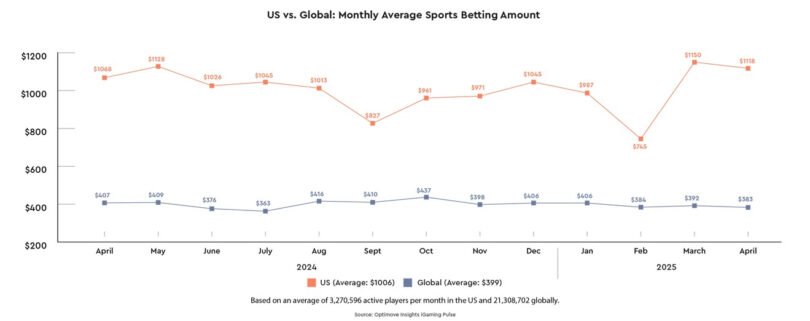

Sports betting tells a different story, with U.S. bettors peaking at $1,150 per month in April 2025, triple the global average of $380.

Yet, the end of the NFL season in February triggered a slowdown, with active U.S. sports bettors growing just 10% year-over-year, far behind the global market’s stable 97% retention, per hipther.com.

Engagement Gap Widens

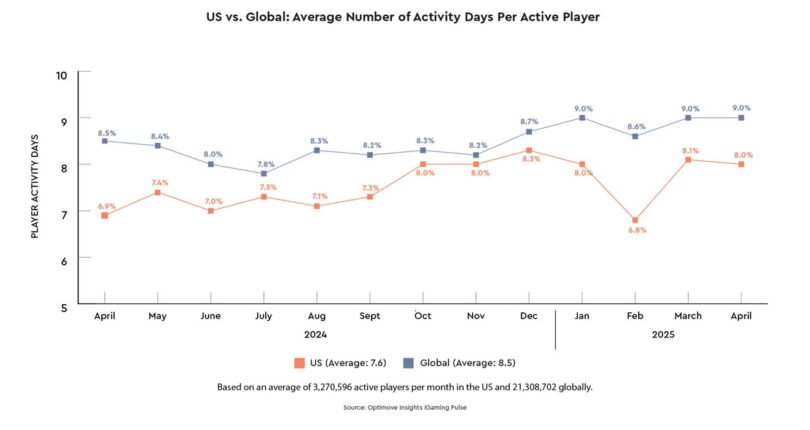

Global players are sticking around longer, averaging 9.01 active days per month in April 2025, 12% more than the U.S.’s 8.04 days.

This engagement edge, consistent over the past year, highlights a challenge for U.S. operators. Platforms need better hooks, like live betting, which drives 54% of bets globally

Retention is another sore spot, with global markets holding a 70.4% active retention rate in April, outpacing the U.S.’s 64.8%. This gap, averaging 70% globally versus 65% in the U.S. over the year, signals weaker player loyalty stateside.

Only 2% of U.S. sports bettors become multi-product players (casino and sports), lagging behind the global 6%.

The U.S. betting market, projected to hit $120 billion by 2029, is a cash cow, but its future hinges on boosting engagement and retention. Operators must lean into personalized campaigns to keep players active beyond seasonal peaks.

Recommended